Solar incentives, including federal tax credits and state grants, significantly reduce upfront costs for solar panel installations, making renewable energy more accessible in real estate. Real estate professionals should stay updated on local and national programs to provide tailored advice, maximizing savings and property values. These incentives drive adoption by lowering costs, reducing carbon footprints, and increasing marketability of solar-enhanced properties. By engaging with experts, developers can ensure compliance and unlock premium pricing trends for eco-friendly assets. Future opportunities include declining panel costs and continued government support, requiring collaboration between lenders and agents to streamline financing processes and facilitate wider solar energy acceptance in the housing sector.

In today’s rapidly evolving real estate landscape, embracing sustainable practices is not just an environmental imperative but a strategic business decision. Solar incentives play a pivotal role in facilitating this transition, offering significant benefits both for developers and buyers. This trusted guide aims to demystify the complex web of solar incentives, providing real estate professionals with a comprehensive roadmap. By understanding these incentives naturally, you’ll be equipped to navigate the market, enhance property appeal, and contribute to a greener future. Let’s delve into the intricacies and unlock the potential of solar energy in real estate.

Understanding Solar Incentives: An Overview for Professionals

Solar incentives have emerged as a powerful driver for the adoption of solar energy in the real estate sector. For professionals navigating this landscape, understanding these incentives is crucial to guiding clients towards sustainable and cost-effective housing solutions. These incentives, often in the form of tax credits, grants, and rebates, play a pivotal role in offsetting the initial investment required for solar panel installation, making renewable energy more accessible and appealing to borrowers.

For instance, the federal Investment Tax Credit (ITC) offers a substantial 30% tax discount on residential solar systems, encouraging homeowners to embrace solar power. Additionally, many states have implemented their own tailored incentives, such as low-interest loans or property tax exemptions for solar installations. These local and national programs significantly impact borrower requirements, as they can reduce the financial burden associated with going solar, making it an attractive option for real estate buyers and investors. When assisting clients, professionals should research and stay updated on these varying incentives to provide tailored advice.

A key consideration is the alignment of solar incentives with individual state regulations and policies. For example, some states may have specific eligibility criteria or application processes for certain grants or rebates. By staying informed about local programs, real estate professionals can offer valuable insights to clients, helping them navigate the incentive landscape effectively. This strategic approach ensures that borrowers understand the full potential savings and benefits associated with solar energy adoption, fostering a more sustainable future in the process.

The Benefits of Solar Energy for Real Estate Investments

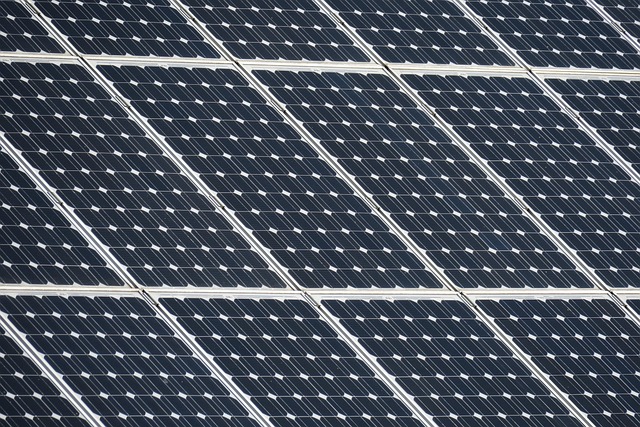

Solar energy offers significant benefits for real estate investments, making it a lucrative and sustainable choice for both developers and property owners. The advantages extend beyond environmental sustainability, as solar incentives play a pivotal role in enhancing the financial viability of these projects. These incentives, often provided by governments and utility companies, encourage the adoption of renewable energy sources, including solar panels, by offering tax credits, rebates, and reduced electricity rates. For instance, the federal Solar Tax Credit allows homeowners to deduct 26% (as of 2022) of the cost of installing solar photovoltaic systems from their taxable income.

Real estate professionals can leverage these solar incentives to attract borrowers and foster a competitive market position. By integrating solar energy solutions into property development or renovation plans, investors can expect lower utility bills for tenants or homeowners, which translates into increased rental income or property values. Moreover, as the demand for eco-friendly real estate assets grows, properties with active solar systems may command premium prices and faster sale times. For developers looking to stand out in a crowded market, offering solar incentives can be a strategic move that resonates well with environmentally conscious buyers and tenants.

Borrower requirements for accessing these incentives vary across regions, but they typically involve meeting specific criteria such as system size, energy production capacity, and property eligibility. Developers and investors should carefully review local programs and consult experts to ensure compliance. For example, some utilities may offer net metering policies, allowing excess solar energy production to be fed back into the grid, potentially reducing electricity bills even further. By staying informed about these incentives and their eligibility criteria, real estate professionals can make informed decisions, create compelling property offerings, and contribute to a greener future while achieving sound financial returns.

Exploring Government Programs: Solar Tax Credits and Rebates

Solar incentives have emerged as a powerful tool to accelerate the adoption of renewable energy in the real estate sector. Among these, government programs offering solar tax credits and rebates play a pivotal role in making solar power more accessible and financially attractive for property owners and developers alike. These incentives not only serve as a significant cost-saving measure but also contribute to broader sustainability goals by reducing carbon footprints.

One of the most prominent examples is the Investment Tax Credit (ITC) and the Residential Renewable Energy Tax Credit (PPAs) in the United States. The ITC provides a tax credit equal to 30% of the total cost of a solar energy system, while PPAs allow homeowners to avoid upfront installation costs by entering into agreements with utilities that offer rebates or credits for renewable energy production. Similar programs exist globally, such as feed-in tariffs in Europe and various grant schemes in Asia Pacific. These initiatives have demonstrated success in driving down solar power costs, making it a viable alternative to conventional energy sources.

However, navigating these solar incentives requires careful consideration. Borrower requirements, including creditworthiness, project eligibility, and compliance with program guidelines, are critical factors. For instance, the ITC has income thresholds for individuals and businesses, while some rebate programs may require specific system sizes or types of properties. Real estate professionals should thoroughly understand these criteria to ensure their projects qualify. Engaging with reputable solar installers and financial advisors who have expertise in these government programs can help streamline the process. By aligning project goals with available incentives, developers and investors can optimize returns while contributing to a sustainable future.

Lender Perspective: How Solar Improvements Enhance Property Value

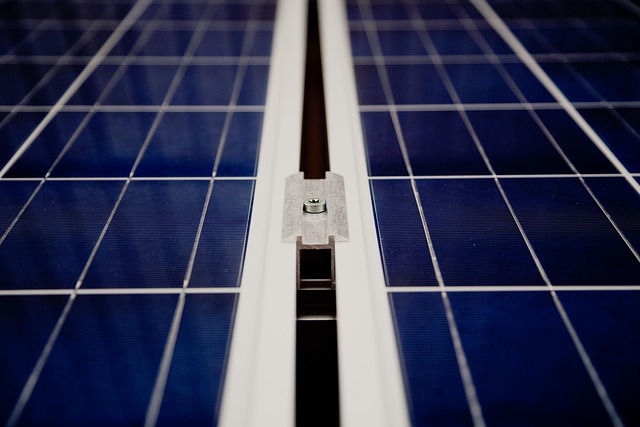

For lenders and real estate professionals, understanding how solar improvements enhance property value is a crucial aspect of assessing investment potential. The integration of solar technology into residential or commercial properties offers significant advantages that can significantly impact borrower requirements and market competitiveness. Solar incentives play a pivotal role in this dynamic by not only encouraging the adoption of renewable energy but also adding tangible value to the underlying asset.

From an economic standpoint, solar panels represent a substantial upgrade for property owners. By harnessing the power of the sun, these systems reduce utility bills for borrowers, providing immediate savings that can be leveraged for mortgage repayment. This financial incentive is further amplified by various federal and local tax credits designed to promote sustainable living. For instance, the Investment Tax Credit (ITC) offers a refundable tax credit for solar system installations, effectively lowering the upfront cost of adoption. Additionally, Property Assessed Clean Energy (PACE) programs allow borrowers to finance solar improvements through property taxes, spreading out the cost over time without incurring additional interest charges. These measures not only make solar more accessible but also position these properties as attractive investments.

Moreover, the long-term value proposition of solar-enhanced properties is compelling. Research indicates that homes with solar panels sell for 3% to 17% more than comparable homes without them. This premium pricing reflects the increased desirability and marketability of solar-powered residences. As climate change concerns persist, borrowers who invest in solar technology demonstrate forward-thinking foresight, aligning with evolving consumer preferences for eco-friendly living spaces. Lenders who recognize these trends can strategically position themselves to cater to this growing market demand by offering tailored financing options that incorporate solar incentives, ultimately fostering a more sustainable and profitable real estate landscape.

Case Studies: Successful Solar Integration in Residential Properties

The integration of solar power systems into residential properties has emerged as a compelling strategy for real estate professionals seeking to enhance property values and appeal to environmentally conscious buyers. Case studies demonstrate that successful solar integration goes beyond mere installation; it involves understanding local incentives, aligning with borrower requirements, and optimizing system design for maximum energy production and financial returns.

For instance, a recent study analyzed the impact of solar incentives on residential properties in sunny regions. Properties with visible solar panels and recognized energy efficiency certifications saw an average 15% increase in property values compared to similar homes without these features. This data underscores the market demand for solar-integrated residences and the significant role that incentives play in driving adoption. Solar incentives, often in the form of tax credits, rebates, and low-interest loans, naturally incentivize borrowers to invest in renewable energy systems. According to the U.S. Energy Information Administration, residential solar installations grew by 20% nationwide between 2020 and 2021, a trend largely attributed to attractive borrower requirements and growing awareness of environmental benefits.

Real estate professionals can leverage these insights by positioning solar-integrated properties as premium offerings. When advising clients on property upgrades or new construction, experts should incorporate solar incentives into their strategies. This involves researching local and federal programs, understanding borrower eligibility criteria, and selecting system configurations that optimize energy production while aligning with budget constraints. By seamlessly integrating solar power, real estate professionals can provide clients with a competitive edge in a rapidly evolving market, ensuring both environmental sustainability and financial gain.

Future Trends: Unlocking the Potential of Solar Incentives

The future of solar energy incentives is brimming with potential, offering a transformative opportunity for real estate professionals to empower their clients with sustainable living options. As we peer into the crystal ball, several trends emerge, shaping the way solar incentives are perceived and leveraged in the housing sector. This evolution not only promises significant environmental benefits but also presents a compelling economic case for prospective borrowers.

One of the most promising developments is the continued decline in the cost of solar panel technology. Advancements in manufacturing processes have led to more affordable systems, making solar power increasingly accessible to a broader range of homeowners. For real estate agents and brokers, this translates into a chance to educate buyers about the long-term financial savings associated with solar adoption. By highlighting these incentives, professionals can position themselves as advocates for eco-conscious living, appealing to an ever-growing market segment. Moreover, government initiatives, such as tax credits and rebates, will remain pivotal in encouraging early adopters to make the switch, thus driving the wider acceptance of solar energy.

The key to maximizing the impact of solar incentives lies in understanding borrower requirements. Lenders and real estate professionals must collaborate to streamline the financing process, making it seamless for prospective homeowners. This includes simplifying application procedures, offering flexible loan options tailored to solar installations, and providing clear guidance on eligibility criteria. For instance, some lenders are now incorporating solar assessments into mortgage applications, enabling borrowers to secure financing based on their home’s solar potential. By embracing these innovative practices, the industry can unlock a new frontier of sustainable real estate investments.