Solar incentives, including federal tax credits (ITC, PTC), state programs (net metering, RECs, property tax exemptions), and grants/rebates (e.g., California), significantly impact real estate markets by enhancing property value and attracting environmentally conscious buyers. These incentives lower initial costs, offer long-term savings on energy bills, and foster sustainable choices. Real estate professionals should stay updated on eligibility criteria and application processes to guide clients effectively, potentially increasing property values. Net metering policies, crucial for understanding local benefits, influence client decisions. By highlighting financial advantages (up to 20% annual electricity cost savings) and environmental benefits, professionals can facilitate the adoption of solar energy.

In today’s rapidly evolving real estate landscape, harnessing the power of solar energy has become a strategic imperative for forward-thinking professionals. Solar incentives play a pivotal role in facilitating this transition, offering substantial benefits both to property owners and developers. However, navigating the intricate web of available incentives can be a complex task, often deterring would-be adopters from reaping these rewards. This article presents a comprehensive, authoritative guide designed explicitly for real estate professionals seeking to unlock the full potential of solar incentives. By demystifying this process, we empower you with the knowledge to make informed decisions, capitalize on lucrative opportunities, and contribute to a more sustainable future.

Understanding Solar Incentives: An Overview for Professionals

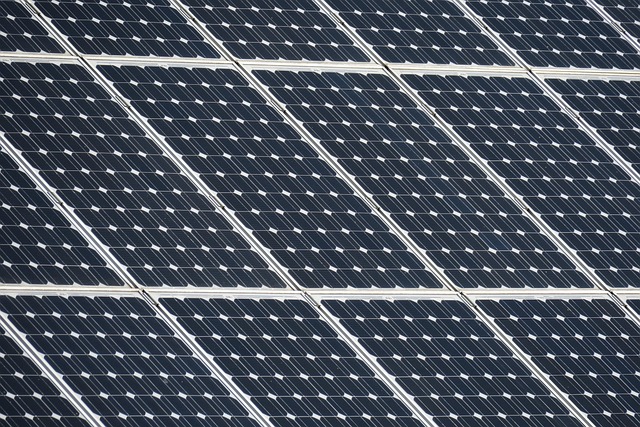

Solar incentives have emerged as powerful tools to accelerate the adoption of solar energy among property owners. For real estate professionals, understanding these incentives is crucial in guiding clients towards sustainable choices and market-competitive options. In today’s climate crisis, where renewable energy sources are increasingly vital, solar incentives offer significant advantages for both homeowners and the industry at large. These incentives can significantly offset the upfront costs of solar panel installation, making clean energy more accessible and attractive to borrowers.

One key aspect that professionals should grasp is the diversity of solar incentive programs available. Federal tax credits, such as the Investment Tax Credit (ITC) and the Production Tax Credit (PTC), are among the most well-known, providing financial relief for both residential and commercial installations. Additionally, many states offer their own unique programs, like net metering, renewable energy certificates (RECs), and property tax exemptions or reductions. For instance, California’s Solar Incentives Program offers a range of benefits, including grants, rebates, and low-interest loans, encouraging widespread solar adoption across the state.

When advising borrowers, professionals must consider the specific requirements for each incentive program. These may include eligibility criteria related to system size, property type, income levels, or time frames for installation. For example, some tax credits phase out based on a sliding scale according to the borrower’s income. Professionals should also be aware of application processes and deadlines, ensuring clients receive the maximum benefits available to them. By staying informed about these ever-evolving incentives, real estate experts can offer valuable counsel, enabling borrowers to make informed decisions that benefit both their pockets and the environment.

How Solar Energy Benefits Real Estate Value

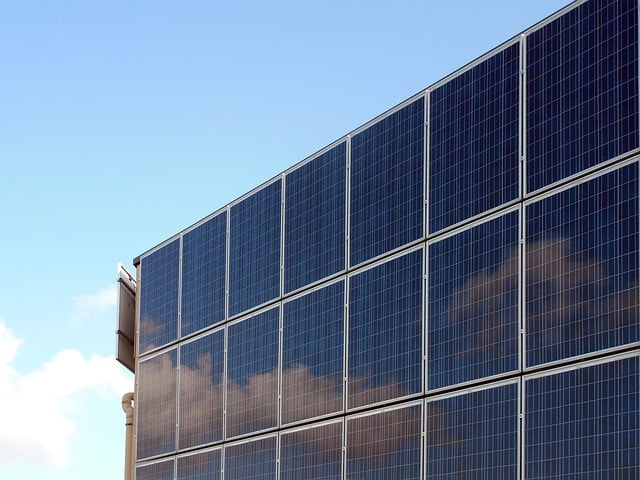

Solar energy has emerged as a powerful tool for real estate professionals, offering significant benefits that extend far beyond environmental sustainability. The adoption of solar power can substantially enhance property value, making it an attractive proposition for both sellers and buyers. This section delves into the intricate ways solar incentives influence real estate markets and provides practical insights for industry experts.

The financial allure of solar energy is a primary driver of its growing popularity in the real estate sector. Solar incentives, such as federal tax credits and rebates, play a pivotal role in making the initial investment more feasible for homeowners. For instance, the U.S. Department of Energy’s Solar Tax Credit has historically offered a generous 30% discount on solar system installations, significantly reducing the out-of-pocket costs for borrowers. These incentives not only encourage individuals to embrace renewable energy but also serve as a marketing tool for real estate agents to showcase properties with existing solar setups. Properties equipped with solar panels often attract premium prices due to their perceived long-term savings and reduced utility expenses.

Moreover, the financial benefits extend beyond initial installation costs. Solar energy systems can lead to substantial savings on energy bills over time, providing borrowers with a steady stream of incentives that lower their monthly expenditures. This is particularly advantageous in regions with high electricity rates, where solar adoption can result in significant long-term savings. For real estate professionals, understanding these borrower requirements and the potential for increased property values is essential when advising clients or evaluating investment opportunities. By staying abreast of evolving solar incentive programs, agents can offer valuable insights to sellers, ensuring their properties remain competitive in the market while attracting environmentally conscious buyers.

Exploring Tax Credits and Rebates: Unlocking Savings

Solar incentives play a pivotal role in making renewable energy more accessible and affordable for real estate professionals. Among these, tax credits and rebates stand out as powerful tools to unlock significant savings for both borrowers and property owners. Understanding these incentives is crucial for navigating the current market landscape, where solar adoption is gaining momentum.

Tax credits, such as the federal Solar Tax Credit (ITC), offer a direct reduction in the amount of tax owed, making solar installations more attractive from a financial perspective. For instance, the ITC currently provides a 26% credit on eligible solar systems through 2022. This benefit is particularly appealing for real estate investors looking to optimize their returns. Rebates, on the other hand, represent a direct cash reduction offered by state or local governments, utility companies, or developers. These incentives can be substantial, potentially covering a large portion of the initial installation costs. For example, some states offer rebates that can exceed $2 per watt of installed solar capacity, amounting to thousands of dollars in savings.

To take advantage of these solar incentives, borrowers must meet specific requirements. These may include system size thresholds, energy efficiency standards for the property, and adherence to local building codes. Real estate professionals should consult with experts to ensure they comply with these criteria, thereby maximizing their financial benefits. Additionally, staying informed about evolving policies and program deadlines is essential. For instance, some tax credits and rebates are subject to change or phase-out, necessitating proactive management on the part of borrowers. By embracing these solar incentives, real estate professionals not only contribute to a sustainable future but also position themselves to benefit from substantial cost savings and enhanced property values over time.

Net Metering and its Impact on Client Decisions

Net metering is a powerful solar incentive that significantly influences client decisions, often serving as a pivotal factor in their choice to adopt renewable energy solutions. This concept allows homeowners with solar panels to feed their excess electricity back into the grid, resulting in reduced energy costs and potentially eliminating their monthly electric bills. The impact on real estate professionals is profound, as it opens doors to compelling opportunities for client engagement and satisfaction.

When advising clients, understanding their local net metering policies is essential. These policies vary by region, dictating how much excess solar energy can be returned to the grid and how credits are applied to future electricity bills. For instance, a client in a state with a 1:1 net metering policy enjoys full credit for their excess energy, making solar adoption more attractive. Conversely, areas with time-of-use rates and complex net metering rules may require additional explanation to demystify the process. As a professional, you can provide valuable guidance by offering insights into these policies and their potential financial benefits, helping clients make informed choices aligned with their solar incentives.

Moreover, discussing the long-term savings and environmental benefits of solar energy alongside net metering can be transformative. Many borrowers are now more inclined to consider solar as a means to reduce their carbon footprint and secure stable energy costs over time. This shift is reflected in recent trends; data shows that areas with robust net metering programs have experienced higher solar adoption rates, indicating a direct correlation between these incentives and client interest. By integrating solar incentives borrower requirements into your consultations, you empower clients to make sustainable choices while ensuring they fully comprehend the potential savings and value of their investment.

Promoting Solar Adoption: Strategies for Real Estate Experts

Promoting Solar Adoption requires a nuanced understanding of solar incentives and their role in facilitating the transition to clean energy for homeowners. As real estate professionals, you have a unique opportunity to guide clients towards these beneficial options. One key strategy is highlighting the financial advantages. Many borrowers are unaware that adopting solar can significantly reduce utility bills over time, creating long-term savings. For instance, according to the U.S. Energy Information Administration, homes with solar panels can save homeowners up to 20% on their electricity costs annually.

Educating clients about available solar incentives is essential. These incentives often include federal tax credits, state rebates, and local grants or net metering programs. By understanding these borrower requirements, you can provide tailored advice, ensuring your clients are aware of the financial benefits at both the federal and state levels. For example, the Investment Tax Credit (ITC) offers a 30% tax credit for solar system installations, while various states offer property tax exemptions or rebates, further encouraging adoption.

Moreover, emphasizing the environmental impact can be a powerful motivator. Real estate professionals can communicate how solar energy reduces carbon footprints and contributes to sustainable living. Data from the International Energy Agency (IEA) shows that widespread solar adoption could reduce global greenhouse gas emissions significantly. This perspective not only appeals to environmentally conscious buyers but also positions your expertise in aligning with current market trends, as green building and renewable energy solutions are increasingly sought after by prospective homeowners.