Solar incentives, including tax credits, rebates, grants, and net metering policies, significantly offset upfront costs for homeowners adopting renewable energy. Eligibility criteria vary; thorough research is essential to maximize benefits. These incentives drive cost savings, promote sustainability, and foster a diverse energy portfolio. Understanding local, state, and federal programs aligns decisions with financial goals while contributing to a sustainable future.

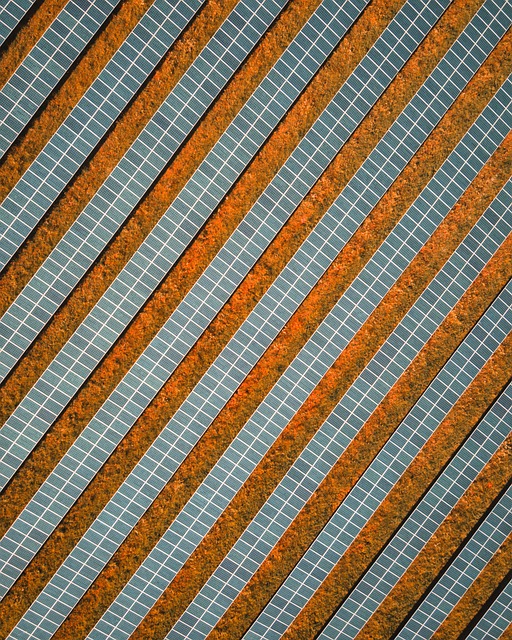

Homeowners increasingly seek sustainable energy solutions, driven by environmental consciousness and cost savings. Solar power, once a niche choice, has emerged as a viable option thanks to advancements in technology and compelling solar incentives. However, navigating the complex web of available programs and understanding their true value can be challenging. This article serves as an authoritative guide, providing deep insights into the world of solar incentives for homeowners. We demystify common misconceptions, highlight key benefits, and offer practical strategies for maximizing savings while transitioning to clean energy. By the end, readers will possess the knowledge to make informed decisions, naturally attracting them to the benefits of solar power.

Understanding Solar Incentives: Unlocking Homeowner Benefits

Solar incentives have emerged as a powerful catalyst for homeowners looking to embrace renewable energy. Understanding these incentives is crucial for unlocking significant benefits that can make solar power an attractive and financially feasible option. At their core, solar incentives are designed to offset the initial costs of installing solar panels, making clean energy accessible to a broader spectrum of homeowners. These incentives take various forms, including tax credits, rebates, grants, and net metering policies, each tailored to encourage different aspects of solar adoption.

For instance, the federal Solar Tax Credit allows homeowners to deduct 26% (as of 2022) of qualified expenses from their taxable income, effectively reducing the cost of going solar. Many states also offer their own incentives, such as rebates or low-interest loans, further alleviating upfront financial burdens. Homeowners can also benefit from net metering policies that credit them for any excess electricity produced by their solar panels, providing a form of revenue and offsetting energy costs over time. It’s important to note that specific borrower requirements vary across these programs, with eligibility often tied to income levels, property ownership status, and system size. For example, the Solar Tax Credit is non-refundable but has no upper limit for eligible expenses, while some state rebates may have both a cap on the amount awarded and specific criteria related to energy efficiency improvements.

Homeowners seeking solar incentives should thoroughly research their local, state, and federal offerings to identify the most applicable and beneficial programs. Consulting with reputable solar installers or financial advisors who specialize in these incentives can provide valuable guidance tailored to individual circumstances. By capitalizing on available solar incentives, homeowners not only contribute to a sustainable future but also gain control over their energy costs, diversifying their energy portfolio and securing long-term savings.

How Solar Panels Can Reduce Your Energy Bills Significantly

Solar panels have emerged as a powerful tool for homeowners looking to reduce their energy bills significantly. The primary driver behind this cost savings is the inherent efficiency of solar technology, which harnesses the abundant and renewable energy from the sun to power homes. In regions with high electricity costs, solar incentives play a crucial role in accelerating the adoption of solar energy, making it an even more attractive option for homeowners. These incentives, often in the form of rebates, tax credits, or net metering policies, are designed to offset the initial installation costs and provide long-term savings.

One of the most significant benefits of going solar is the substantial reduction in electricity bills. According to recent studies, homes equipped with solar panels can save an average of 20-30% on their energy expenses compared to conventional electric grid reliance. This translates into real financial gains over time, as homeowners can expect to see a rapid payback period for their investment. For instance, a typical household in the United States can save around $150-$200 per month by generating their own electricity through solar panels. These savings become even more pronounced in areas with varying weather patterns, where energy consumption tends to fluctuate throughout the year.

To take advantage of these solar incentives, borrowers should be aware of specific requirements set by local and federal authorities. These may include income thresholds, property eligibility, and minimum system sizes. For instance, the Federal Solar Tax Credit offers a significant 26% tax discount on qualified solar systems until 2022, with phase-out periods thereafter. Additionally, many states and municipalities offer their own rebates or net metering programs that can further enhance the financial benefits of going solar. Homeowners interested in solar should proactively research these incentives and consult with reputable solar installers to ensure they maximize their savings potential while navigating the available borrower requirements effectively.

Exploring Government Grants and Tax Credits for Solar Installation

Solar incentives have emerged as a powerful driver for homeowners considering renewable energy adoption, offering financial benefits that can offset the initial costs of solar panel installation. Among these incentives, government grants and tax credits stand out as significant advantages. These offers not only encourage the transition to solar power but also provide much-needed relief for borrowers seeking sustainable energy solutions.

Government grants represent a form of direct financial assistance aimed at promoting solar energy use. These grants are typically awarded based on specific criteria, such as geographic location or income levels. For instance, some countries offer grants covering a substantial portion of the installation costs, making solar power more accessible to low- and middle-income households. According to recent studies, home owners in regions with robust renewable energy policies have seen grants ranging from 30% to 70% of the total project cost. Tax credits, on the other hand, provide a percentage reduction in the amount of tax owed, further alleviating the financial burden of solar panel installation. Many countries offer tax credits that can be claimed at the time of filing annual tax returns, making it an attractive option for homeowners.

While these incentives significantly benefit borrowers, understanding specific requirements is essential. Government grants often come with eligibility criteria related to location, income, and system size. Tax credits, meanwhile, require proper documentation and adherence to reporting guidelines. Homeowners should thoroughly research and consult with professionals to ensure they meet these borrower requirements. By navigating these incentives effectively, homeowners can not only reduce upfront costs but also enjoy long-term savings, contributing to a greener and more sustainable future.

The Role of Utilities in Promoting Solar Adoption with Incentives

Utilities play a pivotal role in promoting solar adoption among homeowners through various incentives designed to make renewable energy more accessible and affordable. One of the most significant contributions comes in the form of net metering policies, which allow solar panel owners to feed their excess electricity back into the grid, reducing their overall energy costs. This not only encourages individuals to invest in solar but also ensures a more balanced distribution of energy consumption across the community.

Many utilities offer rebates and tax credits as part of their incentive programs, providing financial relief to homeowners who install solar panels. These incentives can significantly offset the initial installation costs, making solar a more attractive option for borrowers. For instance, the federal Solar Tax Credit has been instrumental in driving adoption, offering a 26% tax credit for residential solar systems. Some utilities also partner with local and state governments to create tailored programs that cater to specific community needs and economic conditions.

However, navigating these incentives can be complex, as borrower requirements vary widely. Homeowners must understand the eligibility criteria, application processes, and timeframes associated with each program. Utilities often provide detailed guidelines on their websites, offering step-by-step instructions for claiming these benefits. Moreover, staying informed about changes in policies and regulations is crucial, as updates can impact the availability and terms of solar incentives. By leveraging these utility-led initiatives effectively, homeowners can not only reduce energy costs but also contribute to a more sustainable future.

Comparing Cash Rebates vs. Low-Interest Loans for Solar Upgrades

When considering a solar upgrade, homeowners often face a crucial decision: choosing between cash rebates or low-interest loans. Both options offer significant financial benefits tied to solar incentives, but they cater to different borrower profiles and needs. Cash rebates, as the name suggests, involve receiving a direct reduction in the cost of your solar system upon installation. This method is attractive for those seeking an immediate, substantial saving. For instance, some states offer rebates that cover 25-30% of the total project cost, effectively reducing upfront expenses by thousands of dollars.

In contrast, low-interest loans provide funding for the solar installation with the promise of long-term savings through reduced energy bills. These loans typically feature rates far below traditional home improvement financing, making them an appealing option for borrowers who anticipate staying in their homes for several years to reap the full benefits. For example, a 10% fixed loan rate over 20 years can result in substantial savings compared to conventional financing, especially with the added advantage of potential tax credits and deductions. The key difference lies in the timing of savings; cash rebates offer immediate relief, while loans spread the benefit over time.

When evaluating these solar incentives, borrowers should consider their financial situation, energy consumption patterns, and long-term goals. Cash rebates might be ideal for those looking to make a substantial upfront investment or reduce the overall project cost significantly. Conversely, low-interest loans are suitable for prudent borrowers who want to spread out payments over time while enjoying the benefits of clean energy. Understanding these options is essential in making an informed decision that aligns with individual financial strategies and leverages the advantages of solar power.

Long-Term Savings: Measuring ROI of Solar Incentive Investments

Homeowners considering solar incentives for their properties are often driven by the prospect of long-term savings and a return on investment (ROI). While the initial cost of installing solar panels can be significant, understanding the associated solar incentives and their impact on ROI is crucial. These incentives, offered by both federal and local governments, can substantially offset the upfront costs, making solar energy more accessible and attractive to borrowers.

The most common forms of solar incentives include tax credits, rebates, and net metering policies. For instance, the federal Investment Tax Credit (ITC) offers a tax break for homeowners who install solar panels, currently at 30% of qualified expenses. Many states also provide additional benefits, such as sales tax exemptions on solar equipment or property tax credits. These incentives are designed to encourage the adoption of renewable energy and can significantly reduce the overall cost of solar installations. According to the U.S. Energy Information Administration (EIA), residential solar capacity in the U.S. has been growing rapidly, increasing by over 20% annually since 2017, partly due to these favorable policies.

To maximize long-term savings, borrowers should carefully consider their local solar incentive programs and how they interact with their financing options. When evaluating different lenders or solar installation companies, inquire about the specific solar incentives applicable to your area and their impact on the overall cost of ownership. For example, some lenders may offer lower interest rates for borrowers who utilize certain state or federal tax credits. By understanding these borrower requirements and the potential savings, homeowners can make informed decisions that align with their financial goals and contribute to a sustainable future.