Solar incentives significantly reduce upfront costs for homeowners adopting clean energy through various programs like federal tax credits, state rebates, and local grants. Understanding specific requirements, combining federal and state benefits, and consulting experts maximize savings while navigating dynamic regulations to access suitable incentive programs.

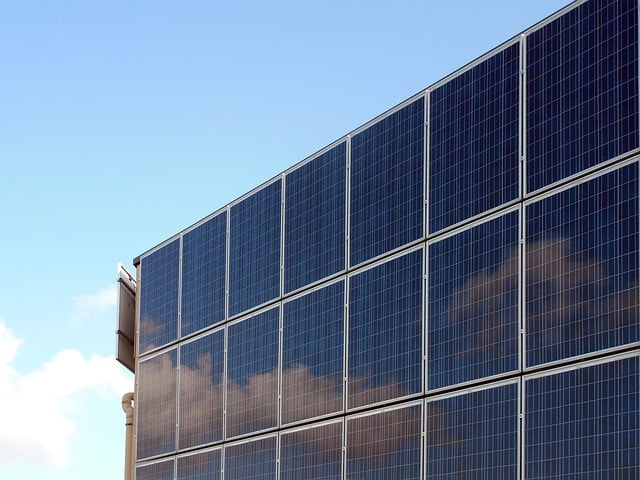

In today’s quest for sustainable living, homeowners increasingly look to solar power as a clean energy alternative. Understanding the available solar incentives is crucial for making this transition financially feasible. The current landscape offers an array of compelling incentives designed to encourage residential solar adoption, from federal tax credits to local rebates and net metering policies. However, navigating these options can be daunting. This comprehensive guide provides homeowners with an in-depth resource explaining the diverse solar incentives naturally available, empowering them to make informed decisions about their energy future. By demystifying these benefits, we aim to facilitate a smoother transition to renewable energy sources.

Understanding Solar Incentives for Homeowners

Solar incentives have emerged as a powerful driver for homeowners looking to embrace clean energy. Understanding these incentives is crucial for any borrower considering solar panel installation. At their core, solar incentives are designed to offset the initial costs of adopting solar power, making it more financially accessible. These come in various forms, from federal tax credits to state rebates and local grants. For instance, the Federal Solar Tax Credit allows homeowners to deduct 26% (as of 2022) of eligible solar system costs from their taxable income, effectively reducing the upfront investment required.

One key aspect to consider when exploring solar incentives for homeowners is the specific borrower requirements. These can vary widely depending on the incentive program and jurisdiction. For federal tax credits, borrowers must own the property where the solar panels are installed and have a valid Social Security number or individual taxpayer identification number. State rebates often involve application processes that require detailed information about the property and proposed system. Homeowners should anticipate gathering documentation such as utility bills and architectural plans to meet these requirements.

Implementing a strategic approach to leveraging solar incentives can significantly enhance the financial viability of solar energy adoption. For example, combining federal tax credits with state-level programs can create substantial savings. Some states offer additional incentives like low-interest loans or property-assessed clean energy (PACE) financing, which further reduce barriers to entry. Homeowners should conduct thorough research on local and regional incentive programs and consult with solar installers who are experts in navigating these complexities. By doing so, they can ensure they receive the maximum benefits available under current solar incentives structures.

Exploring Types of Solar Incentive Programs

Solar incentives have emerged as a powerful driver for homeowners looking to adopt solar power, offering financial benefits and contributing to a cleaner environment. When exploring the world of solar energy, understanding the diverse range of incentive programs available is paramount. These initiatives, often backed by governments or utilities, are designed to offset the initial costs associated with installing solar panels, making clean energy more accessible and affordable for all. This section delves into the intricacies of various solar incentive schemes, providing homeowners with a comprehensive guide to navigate this beneficial landscape.

The types of solar incentives can be broadly categorized based on their structure and benefit. One common approach is performance-based incentives, where borrowers are rewarded for the actual energy production of their solar systems. For instance, in many regions, utility companies offer net metering policies, allowing homeowners to feed excess electricity back into the grid and receive credits or payments for any excess generation. Another popular model includes tax credits and rebates, which directly reduce the cost of installation. Homeowners can claim these incentives based on their solar system’s capacity, with some programs offering a fixed amount per kilowatt installed. A third category focuses on loan and grant programs, providing borrowers with low-interest loans or grants to cover a portion or all of the installation costs. These solar incentives for homeowners often come with specific borrower requirements, such as meeting certain income thresholds or installing systems within a defined capacity range.

When considering these solar incentives, it’s crucial to assess one’s financial situation and energy needs. For example, a homeowner in a region with high electricity rates might find net metering more advantageous, while those seeking significant cost savings could opt for tax credits or grants. Moreover, understanding the local regulations and application processes is essential. Each incentive program has its own set of guidelines and eligibility criteria, ensuring that borrowers receive the appropriate support. As the solar energy sector continues to evolve, so too do these incentives, making it a dynamic field for homeowners looking to embrace clean energy while reaping financial benefits.

Maximizing Solar Savings Through Incentives

Maximizing Solar Savings Through Incentives

Homeowners interested in transitioning to solar power often wonder how they can make this shift more affordable. The answer lies in understanding and leveraging solar incentives. These are financial assistance programs designed to encourage the adoption of renewable energy sources, with a particular focus on solar power. In addition to federal tax credits, numerous states offer their own solar incentives for borrowers, making it an exciting time to consider going solar. For instance, some states provide direct rebates or grants that can significantly offset the upfront costs of solar panel installation. These solar incentives borrower requirements typically involve meeting specific criteria related to your property and energy usage.

One key area where homeowners can maximize savings is through state-level programs. According to recent data, states like California and New York offer some of the most generous solar incentives, allowing borrowers to recover a substantial portion of their initial investment. These programs often come in the form of net metering, where any excess electricity generated by your solar panels can be fed back into the grid, reducing your overall energy bill. As a result, homeowners not only save on their utility expenses but also contribute to a more sustainable future.

To take full advantage of these solar incentives, borrowers should proactively research and understand the specific requirements for their state and local area. This involves assessing eligibility criteria, application processes, and potential timeframes for receiving benefits. By strategically planning and timing your solar installation, you can align with peak incentive periods, ensuring maximum financial support. Furthermore, consulting with a reputable solar installer who has experience navigating these incentives can streamline the process, helping homeowners secure the best possible savings on their solar journey.

Navigating the Application Process for Solar Incentives

Navigating the application process for solar incentives can seem daunting, but with careful planning and a solid understanding of the requirements, homeowners can unlock significant savings and contribute to a cleaner energy future. Solar incentives have evolved into a powerful tool for encouraging residential solar adoption, offering financial support that offsets the initial installation costs. However, these benefits aren’t automatically granted; borrowers must meet specific criteria set by both federal and state programs.

The application process involves careful documentation of energy usage patterns, detailed system design specifications, and compliance with local building codes. Borrowers are typically required to demonstrate a history of energy consumption that justifies the proposed solar installation’s size and capacity. This might include providing previous utility bills as evidence of consistent or increasing energy costs, highlighting the potential for long-term savings. Additionally, lenders and grant administrators scrutinize the property’s value, location, and structural integrity to ensure the investment is sound. For instance, a recent study by the U.S. Energy Information Administration (EIA) revealed that solar adoption rates have been steadily rising, with over 1.8 million residential solar systems installed in the U.S. between 2010 and 2019. This growth indicates a growing acceptance of solar incentives among borrowers who recognize both the environmental and financial benefits.

The solar incentive application process is not one-size-fits-all, as program guidelines vary across regions. Homeowners should research their state’s specific requirements, such as eligible technologies, income thresholds, and application deadlines. Engaging with local solar installers or financial advisors early in the process can provide valuable guidance tailored to individual circumstances. These professionals can help navigate complex forms, ensure compliance, and even assist in securing additional funding opportunities. By understanding the borrower requirements and strategically planning the application, homeowners can successfully access the substantial benefits of solar incentives.