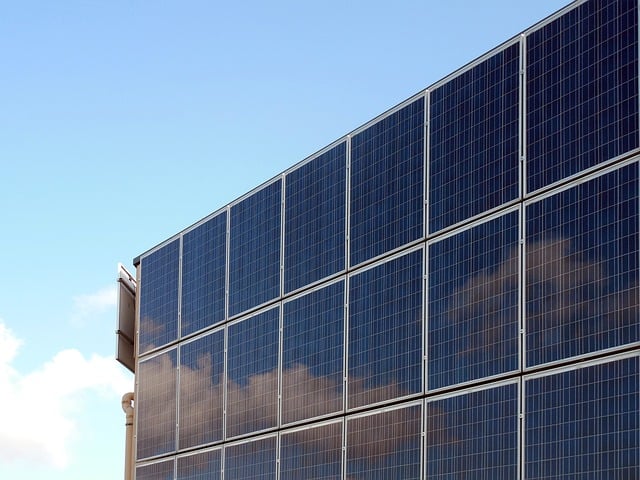

Homeowners increasingly adopt solar energy due to solar incentives like tax credits, rebates, and net metering programs. These incentives, combined with declining technology costs, make solar a financially attractive investment. Federal and state programs offer deductions, grants, and rebates to offset installation expenses. Requirements vary but generally include property ownership, system size, and financial eligibility. Researching available programs and consulting experts is crucial. By leveraging solar incentives, homeowners reduce their carbon footprint and achieve long-term energy bill savings.

Homeownership comes with significant financial responsibilities, and as the cost of energy continues to rise, many homeowners are seeking sustainable and cost-effective solutions. Solar incentives have emerged as a powerful tool, offering substantial benefits for those looking to adopt solar power. This comprehensive guide aims to shed light on the various solar incentives readily available to homeowners, providing an in-depth resource that cuts through complexity. We’ll explore how these incentives naturally lower installation costs, increase long-term savings, and encourage a greener energy future. By the end, readers will be equipped with the knowledge to navigate this landscape and unlock the full potential of solar energy for their homes.

Understanding Solar Incentives: Unlocking Savings for Homeowners

Homeowners increasingly recognize the financial and environmental benefits of embracing solar energy, thanks in large part to compelling solar incentives. These incentives, often coupled with decreasing technology costs, make adopting solar power a shrewd investment for many households. Understanding these incentives is crucial for unlocking significant savings while navigating the borrowing process.

Solar incentives take several forms, most commonly including tax credits, rebates, and net metering. The federal Solar Tax Credit, for instance, allows homeowners to deduct 26% of eligible solar system costs from their taxable income. Many states also offer their own incentives, such as rebates or direct grants, further offsetting installation expenses. These programs encourage the adoption of renewable energy by making solar systems more affordable.

While solar incentives borrower requirements can vary across programs and jurisdictions, they generally involve meeting specific criteria related to property ownership, system size, and financial eligibility. Homeowners should research both federal and state-level programs available in their region. For example, the Solar Resources Map maintained by the U.S. Department of Energy offers a comprehensive overview of state-by-state incentives. Additionally, consulting with a solar installer or financial advisor can help navigate borrower requirements and identify the most suitable incentives for individual circumstances.

By taking advantage of these solar incentives, homeowners not only reduce their carbon footprint but also stand to make substantial savings on energy bills over time. With careful planning and informed decisions, transitioning to solar power becomes a win-win scenario both financially and environmentally.

Federal Tax Credits: A Powerful Solar Incentive for Clean Energy

Solar incentives have become a powerful driver for homeowners considering clean energy adoption. Among these, federal tax credits stand out as one of the most significant solar incentives available to U.S. residents. These credits, offered through programs like the Investment Tax Credit (ITC) and the Residential Energy Tax Credit, incentivize the installation of solar photovoltaic (PV) systems, making them a compelling option for homeowners looking to reduce their carbon footprint and utility bills.

The federal tax credits for solar have evolved over time, with the ITC currently offering a 30% credit for residential solar installations. This means that if you install a solar system, you can claim a refund of up to 30% of the cost when filing your taxes. For instance, if your solar system costs $20,000, you could receive up to $6,000 in tax credits. Such substantial savings make solar more accessible and appealing to homeowners. However, it’s important to note that these benefits are subject to change based on legislative decisions, so borrowers should stay informed about the latest federal solar incentive borrower requirements.

While the financial benefits are significant, understanding the process of claiming these credits is crucial for a seamless experience as a solar incentives borrower. Homeowners must ensure proper documentation and record-keeping during the installation and claim periods. This includes receiving a qualified installer certification from their solar contractor, who should also provide them with relevant forms to complete when filing taxes. Many tax professionals are now equipped to assist with this process, making it more manageable for borrowers. Keeping up with these federal tax credits and the associated requirements not only promotes clean energy adoption but also empowers homeowners to make informed decisions about their energy choices.

State Programs: Exploring Local Solar Incentives and Rebates

State Programs play a pivotal role in incentivizing homeowners to embrace solar energy, offering a range of benefits designed to offset the initial costs of installation. These local solar incentives and rebates are crucial components of many states’ renewable energy strategies, aiming to boost solar adoption and promote environmental sustainability. The key lies in understanding the specific programs available, their eligibility criteria, and how homeowners can leverage these advantages.

Many states have taken proactive measures by establishing dedicated funds or partnerships with private entities to provide financial assistance for solar panel installations. These incentives come in various forms, including cash rebates, tax credits, and low-interest loans. For instance, California’s Solar Incentives Program offers a combination of rebates, net metering, and performance-based incentives, fostering a robust solar market. Similarly, the federal Solar Tax Credit has been instrumental across the nation, encouraging homeowners to make the switch to solar. When considering solar incentives, borrowers should be aware of the requirements, such as system size, energy production targets, and residence type, ensuring they meet these criteria to access available funds.

Homeowners can maximize their savings by researching and comparing state and local programs. Some states offer more generous rebates or tax breaks than others, making it beneficial to shop around for the best deals. Additionally, staying informed about program eligibility rules is essential. For example, some incentives may be tied to specific types of solar systems, energy efficiency measures, or income levels, so borrowers should ensure they align with their circumstances. By taking advantage of these local solar incentives and rebates, homeowners not only reduce upfront costs but also contribute to a cleaner, more sustainable future.

Net Metering: How It Levels the Playing Field for Solar Adoptees

Net metering is a powerful solar incentive that plays a pivotal role in encouraging homeowners to adopt renewable energy sources. This innovative program levels the playing field for solar users by allowing them to generate their electricity and potentially reduce their reliance on traditional power grids. At its core, net metering enables homeowners with solar panels to feed any excess electricity they produce back into the grid in exchange for credits, which can offset future energy costs. For instance, during a sunny day when your solar panels are generating more electricity than your home needs, the surplus energy is sent back to the grid, providing you with credits that can be used to reduce bills during periods of lower generation.

The benefits extend beyond cost savings. Net metering promotes a more efficient and sustainable energy distribution system by encouraging decentralized energy production. As more homeowners opt for solar power, the overall demand on centralized power plants decreases, leading to reduced greenhouse gas emissions and environmental impact. This shift also ensures a more reliable energy supply as local generation sources can supplement grid instability. For example, during rolling blackouts or grid failures, solar homes with battery storage systems can continue to operate independently, contributing to community resilience.

While the advantages are clear, understanding the solar incentives borrower requirements is essential for successful implementation. Homeowners must meet specific criteria, such as having a suitable roof structure and access to the electrical grid. Financial assessments and credit checks may also be conducted to ensure borrowers can manage the loan repayments. Additionally, local regulations and net metering policies vary, so homeowners should research their area’s guidelines to maximize benefits. Consulting with reputable solar installers who provide guidance on these requirements is advisable. They can offer tailored advice, ensuring that adopting solar power aligns with individual financial and environmental goals.

Lender-Based Programs: Financing Options to Make Solar Affordable

Solar incentives have emerged as powerful tools to make solar energy more accessible to homeowners. Among these, lender-based programs stand out as financing options that significantly reduce the upfront costs associated with solar panel installation. These programs, facilitated by banks and financial institutions, offer various lending models tailored to meet the unique needs of solar borrowers. One prominent approach involves fixed-rate loans with attractive interest rates, allowing homeowners to enjoy stable monthly payments over the life of their solar system. For instance, many lenders now provide 100% financing options, enabling borrowers to install solar panels without any out-of-pocket expenses.

The eligibility criteria for these solar incentives vary across lenders but generally include factors such as creditworthiness and loan-to-value ratios. Homeowners interested in availing these offers should maintain a good credit score and have a substantial down payment ready. Some programs also encourage energy-efficient home improvements by bundling loans, making it easier for borrowers to access multiple benefits under one roof. According to recent industry reports, over 70% of solar installations in certain regions are now financed through lender-based programs, highlighting their growing popularity and effectiveness in driving solar adoption.

To maximize the advantages of these incentives, borrowers should thoroughly research available options from various lenders. Consulting with reputable solar installers or financial advisors can provide valuable insights into the specific borrower requirements and help tailor financing solutions to individual circumstances. Additionally, staying informed about government rebates and tax credits further enhances the affordability of solar energy, making it a wise investment for homeowners looking to reduce energy costs and contribute to a sustainable future.

Long-Term Benefits: The Environmental Impact of Going Solar with Incentives

Making the switch to solar power is a significant decision with far-reaching environmental implications. Solar incentives for homeowners offer a compelling reason to embrace this clean energy source. Beyond the immediate financial savings, these incentives play a crucial role in fostering a sustainable future by reducing our carbon footprint and mitigating climate change.

The long-term benefits of going solar are substantial. Once installed, solar panels have minimal environmental impact beyond their manufacturing process. According to the U.S. Department of Energy, solar energy has one of the lowest carbon footprints among renewable resources, with a study showing that solar power systems can avoid over 90% of greenhouse gas emissions associated with electricity generation from conventional sources. This is particularly impactful in regions reliant on fossil fuels for electricity, where transitioning to solar can significantly reduce local pollution levels.

However, maximizing these environmental advantages requires strategic navigation of solar incentives. Borrowers must understand the specific requirements and eligibility criteria associated with various incentive programs. For instance, many governments offer tax credits or rebates for residential solar installations, but these benefits often have deadlines and income thresholds. Additionally, net metering policies allow homeowners to feed excess energy back into the grid, offsetting future electricity bills and further enhancing the environmental return on investment. By carefully considering and taking advantage of available solar incentives, borrowers can ensure that their decision to go solar aligns not only with financial prudence but also with a commitment to preserving our planet’s resources for future generations.