Solar incentives, including federal tax credits (30%), state rebates, and net metering, significantly reduce solar energy costs. Availability varies by location and local programs offer grants, loans, and rebates. Understanding these incentives—tax credits, rebates, net metering—is crucial for maximizing financial benefits and transitioning to clean energy. Research regional guidelines, consult experts, and track energy production for optimal savings. Long-term advantages include energy independence and reduced electricity bills.

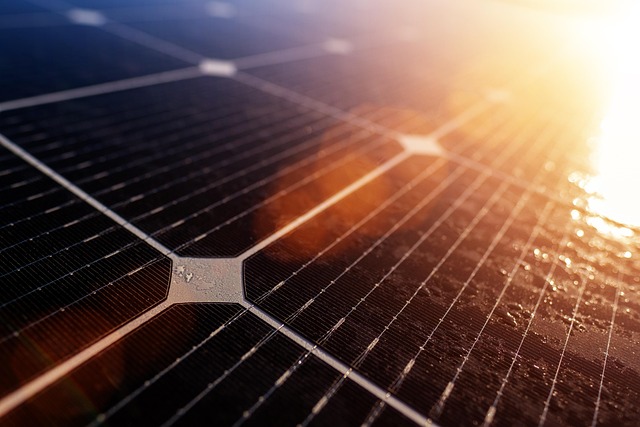

In today’s rapidly changing energy landscape, embracing renewable sources like solar power has become a crucial step towards sustainability and cost savings for consumers. However, navigating the complexities of solar incentives can be a significant hurdle for many. This practical guide aims to demystify the world of solar incentives, providing an authoritative resource for consumers seeking to harness the benefits of solar energy. We will naturally explore various incentive programs, their mechanisms, and how they can significantly reduce the financial burden associated with transitioning to solar power.

Understanding Solar Incentives: Unlocking Savings Potential

Unlocking Savings Potential: Understanding Solar Incentives

Solar incentives have emerged as a powerful driver for homeowners looking to embrace clean energy. These incentives go beyond initial installation costs, offering substantial financial benefits that can make solar power a more accessible and attractive option. Understanding these solar incentives is crucial for consumers aiming to maximize their savings potential. Borrowers should be aware of federal tax credits, state-level rebates, and net metering policies, all of which contribute to the overall cost-effectiveness of solar energy systems. For instance, the Federal Solar Tax Credit, currently at 30%, significantly reduces the out-of-pocket expense for solar installations, making it an attractive proposition for many homeowners.

The availability and specifics of these incentives vary based on geographical location and local renewable energy programs. State-level initiatives often include rebates, grants, or low-interest loans designed to encourage the adoption of solar power. These borrower requirements typically involve application processes that can be streamlined by working with reputable solar installers familiar with navigating such incentives. It’s essential to research and consult with professionals who can guide consumers through these programs, ensuring they receive the maximum benefits available. For example, some states offer time-of-use pricing plans, allowing homeowners to offset daytime energy usage with overnight solar generation, further enhancing savings.

By leveraging these solar incentives, borrowers can significantly reduce their reliance on traditional energy sources and enjoy long-term financial savings. Moreover, as renewable energy policies continue to evolve, staying informed about the latest incentives can unlock even more opportunities for consumers looking to embrace a greener, more sustainable future.

Types of Solar Incentives: Federal to Local Programs

Solar incentives have emerged as powerful catalysts for homeowners and businesses to embrace renewable energy. These incentives, ranging from federal grants to local rebates, play a pivotal role in making solar power more accessible and affordable. Understanding these various programs is crucial for consumers looking to navigate the complexities of adopting solar technology. This practical guide delves into the diverse landscape of solar incentives, focusing on federal to local initiatives, to empower borrowers with valuable insights for their journey towards clean energy.

At the federal level, the Solar Tax Credit (ITC) stands as a cornerstone incentive, offering a tax credit of up to 30% for residential and commercial solar installations. This program has been instrumental in driving industry growth, with data indicating that over half of all solar capacity additions in 2021 were directly attributed to the ITC. Moreover, state-level incentives complement federal efforts, with 34 states plus Washington D.C. offering various rebates, grants, or net metering policies. For instance, California’s Solar Initiative provides a series of incentives tailored to different borrower requirements, including low-income households and businesses.

Local programs further enhance the financial benefits for solar borrowers. Many cities and counties offer rebates, allowing consumers to recover a portion of their initial investment. These local initiatives often target specific neighborhoods or communities, fostering a more inclusive approach to clean energy adoption. For example, some utilities provide net metering policies where excess solar energy is fed back into the grid, potentially reducing electricity bills. Understanding these federal and local incentives is essential for borrowers, as it can significantly impact the overall cost of solar installations.

Eligibility and Requirements: Who Qualifies for Solar?

Solar incentives have become a powerful driver for individuals to adopt renewable energy sources. However, navigating the eligibility and requirements for these solar incentives can be complex. Understanding who qualifies for solar is crucial in unlocking significant financial benefits and contributing to a sustainable future. Let’s demystify this process and guide consumers through the key considerations.

The availability of solar incentives varies across regions, but several common criteria apply universally. Most governments and utility companies offer incentives to encourage the adoption of solar power among consumers. These include tax credits, rebates, net metering, and low-interest loans. For instance, in many countries, homeowners who install solar panels can claim a percentage of their installation costs back from the government as a tax credit. This effectively reduces the upfront investment required for solar panel installation. Additionally, some regions offer grants or subsidies directly to consumers, further offsetting the cost of going solar.

Determining eligibility often involves assessing several factors, including property ownership, location, and energy consumption patterns. Typically, homeowners or business owners who own their properties are eligible for these incentives. In some cases, rental properties may also qualify, provided they meet specific criteria related to energy efficiency upgrades. The amount of the incentive is usually tied to the size of the solar system installed and the local policies in place. For example, a borrower who takes out a solar loan under a government-backed program might be required to pay back a smaller portion of their loan over time due to the incentive, effectively reducing their overall cost for adopting solar power.

It’s essential for consumers to thoroughly research and understand the specific requirements set by their local authorities or utility providers. Many online resources and dedicated government websites offer detailed guidelines on eligibility and application processes for various solar incentives. By staying informed about these opportunities, individuals can make informed decisions and access substantial savings while contributing to a greener planet.

Navigating Rebates and Tax Credits: Maximizing Financial Benefits

Navigating Rebates and Tax Credits: Maximizing Financial Benefits

Solar incentives are a powerful tool for consumers looking to invest in solar energy, offering significant financial savings and encouraging the adoption of clean energy sources. Understanding these incentives, especially rebates and tax credits, is crucial for any borrower considering a switch to solar power. This section provides an in-depth guide on how to navigate these benefits, ensuring you make informed decisions that maximize your financial returns.

Rebates and tax credits are designed to offset the initial cost of installing solar panels, making it more affordable for homeowners and businesses alike. The key lies in understanding eligibility criteria, which vary by region and often depend on factors like the type of system installed and property ownership status. For instance, some programs offer upfront rebates directly to borrowers, while others provide tax credits that reduce future tax liabilities. It’s essential to research and compare these options since each has its advantages. Borrowers should be aware of the maximum credit amounts, applicable deductions, and any additional requirements like minimum energy production or specific system types.

One strategic approach is to time your installation for when incentives are at their peak. Many regions announce seasonal or annual changes in solar incentive programs, allowing borrowers to plan and secure better financial gains. Additionally, keeping an eye on local and federal policies can reveal opportunities. For example, some states offer performance-based incentives where credits increase with the amount of energy produced by your solar system. As a borrower, you might benefit from these programs if you have a robust system that generates substantial energy savings.

To maximize benefits, borrowers should engage in proactive research and planning. This involves staying informed about local and federal regulations, consulting professionals who specialize in solar incentives, and carefully reviewing the terms and conditions of each incentive program. By strategically navigating rebates and tax credits, consumers can reduce upfront costs, speed up the return on investment, and contribute to a more sustainable future.

Net Metering and Energy Production: Tracking Your Solar Savings

One of the most powerful solar incentives currently available is net metering—a mechanism that allows solar energy system owners to feed their excess electricity back into the grid in exchange for credits against future electric bills. This process effectively turns your home or business into a microgrid, producing and consuming power on-site, thereby reducing reliance on traditional utility providers. The key advantage lies in tracking your energy production and understanding how it translates into savings. By monitoring your system’s output, you can optimize its performance and gain greater control over your energy costs.

For instance, consider a homeowner with a 10kW solar array installed under net metering policies. During the summer months, when sunlight is abundant, their system produces significant excess electricity. This surplus energy feeds into the grid, earning them credits at the utility’s retail rate. When the sun sets or on cloudy days, they draw power from the grid as usual but with a potential reduction in costs due to the accumulated credits. This dynamic balancing ensures that solar borrowers can benefit from their clean energy production throughout the year.

Solar incentives like net metering are designed to encourage renewable energy adoption and promote energy independence. To qualify for these benefits, however, consumers must meet specific borrower requirements set by utility companies and local regulations. These may include system size restrictions, property eligibility, and creditworthiness standards. Understanding these criteria is essential when planning to install a solar energy system. It’s advisable to consult with professionals who can guide you through the process, ensuring compliance and maximizing your access to solar incentives.

Long-Term Benefits: Beyond Financial Gains with Solar

The long-term benefits of solar power extend far beyond immediate financial gains for consumers. While upfront costs can be a significant barrier, leveraging solar incentives can make adopting solar energy both economically viable and highly rewarding in the long run. These incentives, often provided by governments and utilities, are designed to encourage the widespread adoption of renewable energy sources like solar. For instance, many solar incentive programs offer tax credits, rebates, or net metering policies that directly offset the cost of installation and operation. According to a recent study, homes with solar panels saw an average 20% reduction in their electricity bills compared to conventional households.

One of the most powerful long-term benefits is energy independence and security. Solar power allows homeowners to generate their own clean, renewable energy, reducing reliance on the traditional grid. This not only lowers vulnerability to power outages but also shields against future price increases. Moreover, as solar technology advances, the efficiency of panels improves while costs continue to decline, making it a smart investment for consumers. For example, modern solar panels can convert over 20% of sunlight into electricity, significantly more than earlier models. This trend suggests that, over time, homeowners will need fewer panels to meet their energy needs and enjoy even greater savings.

However, navigating the world of solar incentives involves understanding borrower requirements. Eligibility criteria vary by region and program, so prospective solar adopters should research specific rules. Common requirements include income thresholds, property ownership status, and adherence to local building codes. For instance, some programs offer incentives exclusively to low-income households or first-time homebuyers. By meeting these criteria, consumers can access significant savings and reap the long-term benefits of reduced energy costs and environmental impact.