Solar incentives, including tax credits (e.g., ITC) and net metering, offer significant financial and environmental benefits to homeowners. Accessing these requires understanding eligibility criteria, researching local programs, and consulting experts. Key federal and state initiatives drive global adoption, offsetting upfront costs, reducing carbon footprints (up to 30 metric tons CO2 saved), and fostering a thriving clean energy market with substantial long-term savings. Property values also increase in areas with high solar adoption rates.

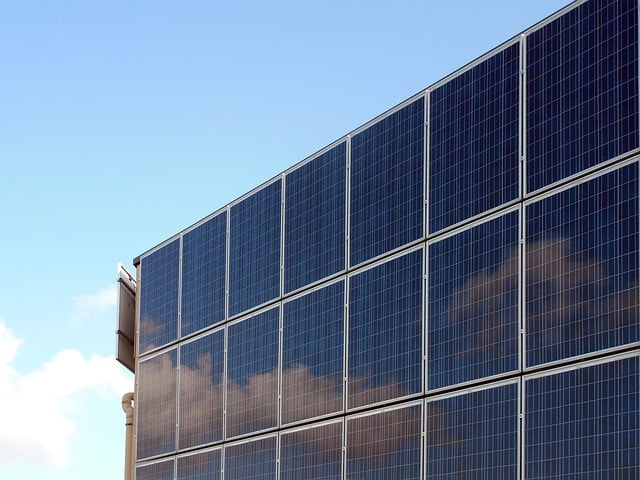

In today’s quest for sustainable energy solutions, homeowners increasingly look to solar power as a viable option. Understanding the available solar incentives is crucial for making informed decisions about adopting renewable energy sources. The current landscape of solar incentives offers substantial benefits, encouraging more property owners to make the switch. However, navigating through various programs and policies can be complex. This article serves as an authoritative guide, offering an in-depth exploration of solar incentives designed to aid homeowners. By demystifying these incentives, we empower folks to naturally embrace solar energy for their homes, contributing to a greener future.

Understanding Solar Incentives for Homeowners

Homeowners interested in harnessing the power of the sun for their energy needs are increasingly benefiting from a range of solar incentives designed to make this transition more accessible and affordable. Understanding these incentives is crucial for anyone considering adopting solar power, as they can significantly impact the financial feasibility and overall appeal of going solar. This section delves into the intricacies of solar incentives specifically tailored for homeowners, providing a comprehensive guide to navigating this aspect of the renewable energy landscape.

Solar incentives come in various forms, each serving a unique purpose in promoting the adoption of solar energy. Tax credits, such as the federal Investment Tax Credit (ITC) and state-level incentives like net metering policies, are among the most common. For instance, the ITC offers a tax credit of up to 30% for residential solar installations, effectively reducing the overall cost of the system. Net metering allows homeowners with excess solar energy to feed it back into the grid, earning credits that can be used during periods of high electricity usage. These incentives are designed to offset the initial installation costs and provide long-term savings on energy bills. Homeowners should explore both federal and state programs, as eligibility and benefits vary across regions.

Borrower requirements play a significant role in accessing these solar incentives. Lenders often require borrowers to meet certain criteria, such as establishing good creditworthiness and demonstrating the ability to repay the loan. For example, a borrower seeking a solar loan might need to provide proof of income, employment history, and a credit score that meets the lender’s minimum standards. Additionally, homeowners should be prepared to document the property’s title and ensure it complies with local zoning regulations. Understanding these requirements in advance allows borrowers to gather the necessary documentation efficiently, streamlining the process of securing financing for their solar projects.

When considering solar incentives, it is beneficial to consult industry experts and stay updated on changing policies. Homeowners can benefit from professional advice tailored to their specific circumstances. For instance, a solar installer or financial consultant can help navigate complex eligibility criteria and identify available incentives that align with an individual’s goals. Keeping abreast of policy developments ensures that homeowners take advantage of the most advantageous programs as they emerge. With careful planning and an understanding of these incentives, adopting solar power becomes not just an environmentally conscious choice but also a smart financial decision for many homeowners.

How to Access and Maximize Solar Incentives

Homeowners increasingly recognize the environmental and economic benefits of solar power, but navigating the complex landscape of solar incentives can be daunting. Accessing and maximizing these incentives is crucial for offsetting the initial cost of solar panel installation and reaping long-term savings. This process involves understanding both federal and local programs designed to encourage the adoption of renewable energy.

The most significant federal incentive is the Investment Tax Credit (ITC), which offers a tax credit of up to 30% for residential solar installations. However, there are specific borrower requirements that must be met to qualify. For instance, the system must be installed on a residential property, and the owner must claim the credit during the year of installation or in the following year. Additionally, state-level incentives, like net metering and renewable energy credits (RECs), further reduce the financial burden of solar adoption. These programs allow homeowners to offset their electricity bills with surplus solar energy produced, effectively turning their homes into microgrids that contribute to a cleaner environment.

Local governments and utility companies also play a vital role in providing solar incentives. Many offer rebates or grants for solar panel installations, which can significantly lower upfront costs. For example, some cities have implemented “solar ready” initiatives, ensuring new home constructions are equipped with easy-to-install solar panels. Homeowners should proactively research these local programs, as eligibility and amounts vary widely. To maximize incentives, borrowers should consider a strategic approach—calculating the total cost of installation, comparing available credits and rebates, and selecting a reputable solar installer who can guide them through the process. By staying informed about federal and local solar incentive programs and meeting the associated borrower requirements, homeowners can leverage these benefits to make their transition to solar energy smoother and more financially viable.

The Environmental and Economic Benefits of Solar Power

The environmental and economic benefits of solar power have captivated homeowners and policymakers alike, driving a global shift towards sustainable energy sources. Solar incentives play a pivotal role in this transition by making solar adoption more accessible and attractive. These incentives, often in the form of rebates, tax credits, or net metering policies, are designed to offset the upfront costs of installing solar panels, significantly enhancing the financial viability for homeowners.

One of the most profound advantages lies in the reduction of carbon footprints. Solar power generation produces zero greenhouse gas emissions, contributing to the fight against climate change. According to a recent study, homes equipped with solar panels can save up to 30 metric tons of CO2 over their system’s lifetime, which is comparable to planting more than 80 trees or removing two cars from the road annually. Moreover, as renewable energy technologies improve and become more efficient, their environmental benefits compound, making them a strategic choice for eco-conscious homeowners.

From an economic perspective, solar incentives have fostered a thriving market for clean energy. Many borrowers find that the savings on their electricity bills quickly offset the initial investment, often within 5–8 years. For instance, in regions with generous tax credits, homeowners can expect a significant return on their investment, reducing energy costs by up to 70% annually. Additionally, property values tend to increase in areas known for high solar adoption rates, providing long-term financial security and potential benefits during real estate transactions. These incentives not only encourage individual action but also drive down the overall cost of renewable energy technologies, making them increasingly accessible and beneficial for borrowers seeking sustainable solutions.