Selling your home? Solar incentives offer significant financial and environmental benefits. Governments provide tax credits, rebates, grants, and net metering to promote renewable energy adoption. These savings can boost property value, attract eco-conscious buyers, and reduce utility bills. Strategic timing and expert guidance maximize ROI and appeal in a competitive market. Solar power is a compelling investment with long-term advantages recognized by lenders.

In today’s rapidly evolving real estate landscape, solar incentives have emerged as a powerful tool for both sellers and buyers alike. As the world grapples with climate change, embracing renewable energy solutions like solar power has become not just an environmental imperative but also a strategic financial decision. However, navigating the complexities of these incentives can be daunting for sellers looking to maximize their returns. This article provides an authoritative guide, delving into the intricate details of solar incentives and offering practical insights to help sellers unlock significant benefits while selling their properties in a rapidly changing market.

Understanding Solar Incentives for Sellers

Selling your home can be a complex process, especially when considering the integration of renewable energy solutions like solar power. Solar incentives for sellers offer an opportunity to enhance their market position while contributing to a sustainable future. These incentives are designed to encourage homeowners to adopt solar energy, providing financial benefits that can significantly impact both the seller’s bottom line and the environment. Understanding these incentives is crucial for sellers looking to navigate the current real estate landscape effectively.

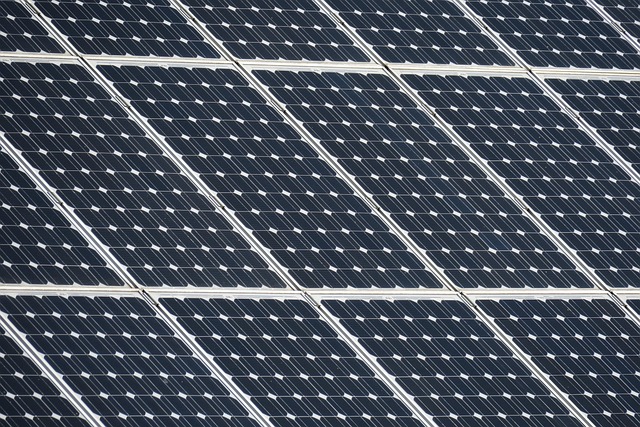

One of the primary drivers behind solar incentives is the growing global push towards renewable energy sources. Governments worldwide are promoting the adoption of solar power as a way to reduce carbon emissions and combat climate change. In response, many countries have implemented policies that offer financial rewards for homeowners who install solar panels. These incentives typically manifest as tax credits, rebates, or grants, with specific borrower requirements varying across regions. For instance, in the United States, the federal Investment Tax Credit (ITC) allows homeowners to claim a credit of up to 30% on their solar system cost, while some states also offer additional incentives. Similar programs exist in Europe and Asia, each with its unique set of eligibility criteria.

Sellers can leverage these solar incentives to attract buyers who value sustainability and energy efficiency. By offering a well-priced property with the added benefit of reduced electricity bills due to solar power, sellers can gain a competitive edge. Moreover, as the cost of solar technology continues to decrease, the financial burden on both borrowers and lenders is reducing, making it an increasingly viable option for homeowners looking to streamline their energy consumption. When preparing your home for sale, consider consulting with solar energy experts who can guide you through the process, ensuring compliance with local regulations and maximizing the potential benefits of going solar. This strategic approach not only enhances the appeal of your property but also contributes to a greener future.

Benefits of Going Solar: Financial Savings

Going solar offers homeowners significant financial savings, making it a compelling investment. The primary driver of these savings is the reduction in electricity bills, as solar panels generate clean energy from sunlight, offsetting or even eliminating your reliance on the grid. Consider this: homes with solar installations can save an average of 20-30% on their annual energy costs compared to conventional electricity sources. Over time, these savings accumulate, leading to substantial returns on investment—some studies show that homeowners who go solar can expect to save tens of thousands of dollars over the lifetime of their system.

Solar incentives play a crucial role in enhancing these financial benefits. Many governments and utilities offer various rebates, tax credits, and grants to encourage the adoption of solar energy. These incentives naturally vary by location but typically include federal tax credits that cover a portion of the installation costs, up to 26% as of recent years. Additionally, some states provide their own programs, such as net metering policies that allow homeowners to sell back excess electricity generated by their panels. For instance, in California, net metering rules enable borrowers to receive credit for any electricity their solar systems produce beyond their immediate needs.

When considering solar incentives borrower requirements, it’s essential to understand the eligibility criteria specific to your region. Generally, these involve meeting certain property ownership and creditworthiness standards. Borrowers may need to demonstrate a good credit history and the financial capability to cover the initial investment. However, many lenders offer financing options tailored for solar installations, making it easier for homeowners to access this technology. By taking advantage of available incentives and funding mechanisms, borrowers can significantly reduce their upfront costs, making going solar an even more attractive proposition.

Exploring Government and Utility Program Support

Solar incentives have emerged as powerful catalysts for homeowners considering a transition to renewable energy sources. Among these, government and utility programs stand out as significant supports for sellers looking to embrace solar power. These initiatives are designed to offset the initial installation costs, making solar panels more accessible and affordable. For instance, many states offer tax credits and rebates that directly reduce the financial burden of adopting solar technology. According to the U.S. Energy Information Administration, over 30 states have adopted policies encouraging solar energy adoption, with some providing up to a 50% reduction in installation expenses.

Government-backed loans and grants are another crucial component of these incentives. These programs cater to both residential and commercial sellers by offering low-interest financing options or direct aid. The U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy (EERE) administers various grant opportunities, targeting specific projects like community solar installations and research into advanced solar technologies. By participating in these schemes, solar panel sellers can access capital without incurring substantial upfront costs, facilitating a smoother transition to clean energy generation.

Understanding the specific borrower requirements for these solar incentives is paramount. Each program has its eligibility criteria, which typically include homeownership status, location, and income levels. For instance, some tax credits are non-transferable and may require the owner to occupy the property for a specified period. Sellers must meticulously review these conditions to ensure they meet the qualifications. Moreover, keeping abreast of evolving policy landscapes is vital, as federal, state, and local incentives can fluctuate, offering dynamic opportunities for those seeking to capitalize on solar energy’s economic and environmental benefits.

Maximizing Return on Investment (ROI) with Solar

Maximizing Return on Investment (ROI) with Solar involves a strategic approach to leveraging solar incentives for sellers. These incentives, offered by both federal and state governments, can significantly offset the upfront costs of installing solar panels. For instance, in 2022, the average residential solar installation in the U.S. saved homeowners approximately $1,500 on their energy bills over the first five years, thanks to various solar incentives. To maximize ROI, sellers should understand and meet the specific borrower requirements associated with these incentives. These requirements often include creditworthiness, property location, and compliance with local building codes. For example, some federal tax credits require the seller to be a U.S. resident or citizen, while others have caps on income levels.

One of the most effective strategies is to structure the solar project as an asset that can be sold along with the property. This approach leverages the inherent value of solar energy production over time. Sellers can negotiate higher sale prices by showcasing the long-term savings and reduced utility costs associated with a solar system. Additionally, some states offer grants or rebates directly to buyers who purchase homes equipped with solar panels, further enhancing the ROI. It’s crucial to consult local and state programs as requirements and benefits vary widely.

To ensure a robust investment, sellers should engage with reputable solar installers who can provide detailed analyses of projected energy savings and return on investment. These professionals can guide sellers through the application processes for various incentives, ensuring compliance with borrower requirements. By strategically timing the installation and sale, sellers can maximize both the financial benefits of solar power and the overall value of their property in a competitive real estate market.

The Environmental Impact and Long-Term Value

Solar incentives have emerged as a powerful driver for homeowners considering renewable energy adoption, offering significant environmental benefits and long-term value. These incentives, often in the form of tax credits, rebates, or grants, are designed to offset the initial installation costs associated with solar panel systems. As global efforts to combat climate change intensify, understanding these incentives is crucial for both sellers and borrowers navigating the real estate market. By embracing solar power, sellers can contribute to a cleaner environment while potentially enhancing their property’s appeal and long-term financial prospects.

The environmental impact of solar energy is profound. Solar panels harness the sun’s rays, converting them into electricity with minimal greenhouse gas emissions. This shift from traditional fossil fuels reduces carbon footprints and helps combat global warming. For instance, according to a recent study, homes equipped with solar panels reduce their annual carbon dioxide emissions by an average of 30 metric tons—equivalent to planting nearly 100 trees or avoiding the emission of almost 40,000 miles of car travel. Solar incentives naturally encourage such eco-friendly practices. Homeowners, particularly borrowers taking out mortgages, can benefit from federal tax credits that cover up to 26% of installation costs (as of 2022). These savings can be passed on to sellers as part of a competitive pricing strategy, appealing to environmentally conscious buyers.

Moreover, solar incentives offer long-term financial advantages. Once installed, solar panels provide free, clean energy for years to come, drastically reducing utility bills. This is especially advantageous in regions with high electricity rates or unpredictable climate patterns. For sellers, offering properties with existing solar systems can attract borrowers seeking sustainable living options. Many lenders now consider the value of renewable energy features when assessing mortgage applications. This trend recognizes that solar incentives borrower requirements are not just environmental responsibilities but also smart financial decisions with tangible benefits. As the cost of solar technology continues to decline, the long-term savings can be substantial, making these systems an increasingly attractive investment for homeowners and a key consideration in real estate transactions.