Selling property? Solar incentives offer significant financial benefits: federal tax credits reduce upfront costs, saving up to 20% on energy bills, and homes with solar panels sell faster and at higher prices. Research local and federal incentives like the Federal Solar Tax Credit and state-specific programs. Assess eligibility based on credit scores and financial stability. Engage reputable contractors and lenders for compliance and maximum savings. Showcase cost efficiency and environmental responsibility to attract eco-conscious buyers, maximizing both financial benefits and property value in a growing solar market.

In today’s rapidly evolving market, solar incentives have emerged as powerful tools for real estate sellers looking to navigate the competitive landscape. As the world shifts towards sustainable energy solutions, understanding these incentives is crucial for maximizing property value and appealing to eco-conscious buyers. The problem lies in the complexity of these programs, often leaving sellers unaware of their eligibility and the significant benefits they offer. This article serves as a comprehensive guide, demystifying solar incentives and providing an expert explanation tailored for real estate professionals and savvy sellers alike. By the end, you’ll be equipped to naturally leverage these incentives, enhancing your sales strategy and contributing to a greener future.

Understanding Solar Incentives for Sellers

Selling your property can be a significant financial decision, and in today’s market, harnessing the power of solar energy can significantly boost its appeal. Understanding solar incentives for sellers is crucial in navigating this evolving real estate landscape. These incentives are designed to encourage homeowners to install solar panels, which not only reduces their carbon footprint but also adds value to their property. For instance, federal tax credits and grants, such as the Investment Tax Credit (ITC) and the Solar Tax Credit, can drastically lower the upfront costs of solar panel installation, making it a more attractive option for sellers looking to maximize their return on investment.

One of the key benefits for sellers lies in the potential for long-term cost savings. Solar incentives often come with reduced electricity bills, which can be a significant selling point when marketing your property. According to recent data, homeowners with solar panels save an average of 20% on their energy costs annually. When it comes to borrower requirements, many lenders now offer specialized loans tailored for solar installations, making the process more accessible and affordable. These loans allow borrowers to include the cost of solar panel installation in their mortgage, effectively spreading out the financial burden over time.

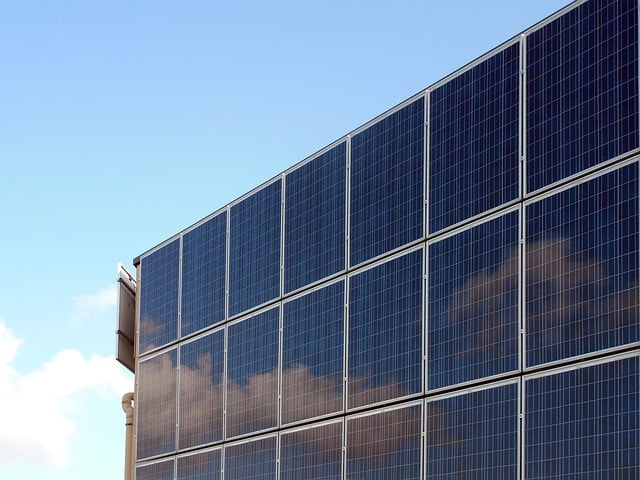

Moreover, sellers can take advantage of increased property value due to solar incentives. Studies have shown that homes with solar panels often command higher sale prices and experience quicker sales times. This is particularly true in regions with a strong focus on sustainability and renewable energy. By embracing these incentives, sellers not only contribute to a greener future but also position their properties as desirable choices for environmentally conscious buyers. When presenting your property, highlight the benefits of solar power—from cost savings to its positive impact on the environment—to appeal to a broader range of potential buyers.

Benefits of Solar Energy for Real Estate

The integration of solar energy in real estate offers a compelling set of benefits for sellers looking to enhance their properties’ value and appeal. Solar incentives, designed to encourage the adoption of renewable energy sources, play a pivotal role in this transformation. These incentives not only reduce the upfront costs associated with installing solar panels but also attract environmentally conscious buyers who prioritize sustainability. For instance, federal tax credits and rebates can offset a significant portion of the initial investment, making solar power more accessible and economically viable for homeowners.

One of the primary advantages lies in long-term cost savings. Solar energy systems allow property owners to generate their own electricity, potentially reducing utility bills over time. This is particularly advantageous in regions with high energy costs or fluctuating rates. Moreover, some local utilities offer net metering policies, enabling borrowers to sell excess energy back to the grid and further offset their energy expenses. As a result, solar incentives not only encourage a greener future but also provide tangible financial benefits that can enhance a property’s market competitiveness.

Selling properties with active solar systems can open doors to a wider range of buyers who appreciate eco-friendly features. According to recent studies, homes equipped with renewable energy sources like solar power tend to fetch higher prices and experience shorter selling times compared to their conventional counterparts. This trend underscores the growing demand for sustainable living among potential borrowers. By embracing solar incentives, real estate sellers can position their properties as cutting-edge, forward-thinking investments that cater to a significant segment of today’s buyer market. Ultimately, understanding and leveraging these incentives can be a strategic move to maximize returns on real estate investments while contributing to a more sustainable future.

Navigating Solar Incentives: A Step-by-Step Guide

Navigating Solar Incentives: A Practical Guide for Sellers

Selling a home with solar panels installed or planning to install them before putting your property on the market can be an attractive proposition for both sellers and buyers alike. Understanding solar incentives is crucial in this process, as these financial benefits can significantly impact your bottom line. This guide offers a step-by-step approach to help you demystify solar incentives and ensure you maximize the advantages.

The first step is to familiarize yourself with local and federal solar incentives. These incentives often include tax credits, rebates, and net metering policies. For instance, the Federal Solar Tax Credit allows borrowers to deduct 26% of eligible solar system costs from their taxable income, with no cap on the size of the system. Many states also offer their own programs; California, for example, has one of the most comprehensive sets, including a low-interest loan program and property tax exemptions for solar installations. Understanding these solar incentives borrower requirements is key because they vary widely across regions and change periodically, so stay updated with local and federal guidelines.

Once you’ve identified applicable incentives, the next step is to determine your eligibility. Lenders typically consider factors such as creditworthiness and debt-to-income ratios when approving solar loans. It’s important to maintain a good credit score and ensure your finances are in order before applying for a solar loan. Many lenders now offer specialized solar loans tailored to borrowers’ unique needs, making the process more accessible. For instance, some programs cater to homeowners looking to finance their entire solar system or those who want to cover only a portion of the costs.

Finally, work with reputable contractors and lenders who can guide you through the application process and ensure compliance with solar incentives. They can help you navigate paperwork, secure necessary permits, and maximize your savings. Remember, while solar incentives are powerful tools, they should complement a well-priced property listing and effective marketing strategies to achieve a successful sale. By staying informed about these benefits, you can make informed decisions that benefit both you and the environment.

Financial Advantages of Solar Installation for Sellers

Selling your home? Consider solar power—it’s more than just an eco-friendly choice; it’s a strategic financial decision with significant advantages. The financial incentives behind solar installation for sellers are compelling, offering both short-term gains and long-term savings. One of the most direct benefits is the potential for substantial cost reductions. Solar panels can significantly lower electricity bills, especially in regions with high energy costs. According to recent studies, homeowners with solar installations typically save 20-30% on their annual energy expenses. These savings can be passed on to prospective buyers, making your property more attractive in a competitive market.

Moreover, many jurisdictions offer solar incentives designed to encourage the adoption of renewable energy. Tax credits, rebates, and net metering policies are common across various states. For instance, some areas provide upfront cash rebates for each kilowatt-hour (kWh) of electricity produced by solar panels, effectively reducing the initial installation cost. Additionally, federal tax credits can cover a substantial portion of the total expense. These incentives vary based on location and policy updates, so sellers should stay informed about local programs. By understanding these borrower requirements, you can optimize your savings potential and make a compelling case for why solar power is a wise investment.

When selling, showcasing these financial advantages to potential buyers can be a powerful strategy. Not only does it highlight cost savings but also positions your property as forward-thinking and environmentally responsible. Many buyers are now seeking energy-efficient homes, and offering a fully integrated solar system can set your listing apart. Furthermore, some lenders offer special financing options for solar installations, making the process more accessible and affordable for borrowers. By combining these incentives and showcasing their benefits, sellers can enhance their bargaining position and potentially accelerate the sales process.

Maximizing Solar Incentives in the Real Estate Market

Maximizing Solar Incentives in the Real Estate Market involves a strategic interplay between financial incentives and buyer preferences. As solar power becomes increasingly mainstream, sellers can leverage significant savings opportunities by embracing renewable energy sources. The key lies in understanding how to navigate the complex landscape of solar incentives effectively. These incentives, offered by both federal and local governments, often come in the form of tax credits, rebates, or net metering programs. For instance, the Federal Investment Tax Credit (ITC) currently offers a 30% discount on solar system installations, with no upper limit on the credit amount. Such initiatives not only reduce upfront installation costs but also position properties as highly desirable to eco-conscious buyers.

To maximize these benefits, sellers should begin by assessing their solar incentives borrower requirements. This includes evaluating eligibility criteria, such as property location, system size, and local utility regulations. For example, some regions may mandate specific minimum energy efficiency standards for homes with solar panels. Once these requirements are understood, homeowners can make informed decisions about system design and installation, ensuring they align with available incentives. A professional solar installer can play a pivotal role here, guiding sellers through the process and helping them secure the most advantageous financing options.

Additionally, understanding market trends is paramount. Recent data indicates that homes with solar panels sell for 10-15% more than comparable properties without these systems. This premium highlights the growing demand for sustainable living among buyers. Sellers can further enhance their advantage by marketing their properties as environmentally friendly and energy-efficient, appealing to a broader range of prospective purchasers. By combining strategic incentives utilization with effective marketing, sellers can not only offset installation costs but also capitalize on the increasing market value of solar-powered homes.