Solar incentives, including federal tax credits (up to 30% deduction) and state programs (rebates, net metering), offer significant financial benefits for homeowners adopting renewable energy. Eligibility requires meeting specific conditions like property ownership and residence status. Local research is crucial, as state-level benefits vary widely. Reputable solar installers can help optimize savings, and community solar programs benefit low-income households. Maximize returns by evaluating upfront cost savings and long-term benefits, ensuring substantial incentives and reduced carbon footprint.

In the global push for sustainable energy solutions, harnessing the power of the sun has emerged as a beacon of hope. Solar incentives, naturally, play a pivotal role in encouraging consumers to adopt clean energy technologies. However, navigating this landscape can be daunting for those new to solar power. This comprehensive guide aims to demystify the process by providing an authoritative overview of available solar incentives and how they can significantly offset the initial costs of installation. By the end, readers will be equipped with the knowledge to make informed decisions about transitioning to solar energy, contributing to a greener future.

Understanding Solar Incentives: Unlocking Savings Potential

Unlocking Savings Potential: Understanding Solar Incentives

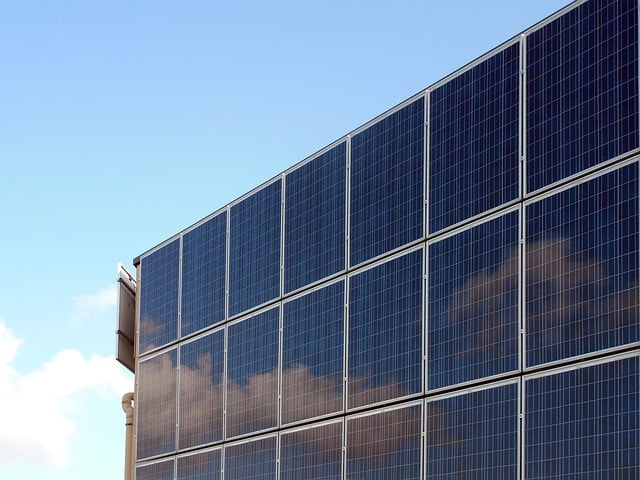

Solar incentives have emerged as a powerful driver for homeowners looking to embrace renewable energy. These financial enticements, offered by both federal and local governments, can significantly offset the upfront costs of installing solar panels. At their core, solar incentives are designed to promote widespread adoption of solar power, contributing to a cleaner environment and energy independence. For consumers, this means accessing savings that can pay for themselves over time through reduced electricity bills.

One of the most prominent and widely recognized solar incentives is the federal Investment Tax Credit (ITC). This program allows homeowners to deduct a substantial portion—currently up to 30%—of their solar installation costs from their taxable income. For instance, if you install a solar array with a $20,000 price tag, you could claim a tax credit of up to $6,000 in the year of installation. Additionally, many states offer their own incentives, such as rebates or net metering programs, which further enhance the financial benefits of going solar. These state-level initiatives can provide additional savings, sometimes reaching 50% or more of the installation cost.

However, it’s essential to understand that accessing these benefits comes with certain borrower requirements. For federal ITC eligibility, you must own the property where the solar panels are installed and use it as your primary residence. Some state programs may have residency or income thresholds as well. It’s crucial for consumers to research and ensure they meet these criteria before applying for solar incentives. By carefully navigating these requirements, homeowners can unlock substantial savings potential, making their transition to clean energy both financially prudent and environmentally responsible.

Navigating Rebates, Tax Credits, and Other Benefits

Navigating the world of solar incentives can seem like a complex task for consumers, but understanding these benefits is crucial in making informed decisions about adopting renewable energy sources. Solar incentives are designed to encourage individuals and businesses to invest in solar power systems, offering various rebates, tax credits, and other advantages that can significantly reduce the overall cost of going solar. This practical guide aims to demystify these incentives and equip borrowers with the knowledge needed to maximize their savings.

One of the most prominent solar incentives is the Federal Tax Credit, which allows homeowners and businesses to deduct a substantial portion of their solar system’s cost from their taxable income. For example, in 2023, eligible taxpayers can claim a 30% tax credit for qualified solar energy systems. Additionally, many states offer their own incentives, such as rebates or net metering policies, which further offset the initial investment. These state-level benefits vary widely, so borrowers should research their local programs to take full advantage. For instance, California’s Solar Incentives Program offers a variety of options, including direct payments and performance-based incentives, providing substantial savings for eligible residents.

Borrowers should also be aware that certain solar incentive programs have specific requirements. These may include minimum system size, geographic location, or income thresholds. Understanding these criteria is essential to ensure eligibility. For example, some rebates are targeted at low-income households, while others incentivize solar adoption in rural areas. By aligning their needs with available incentives, borrowers can optimize their savings. Consulting with a reputable solar installer who understands these programs can provide valuable guidance and help navigate the application processes, ensuring consumers receive the full benefits they’re entitled to.

Maximizing Returns: Choosing the Right Solar Incentive Programs

Maximizing Returns on Your Solar Investment: Navigating Incentive Programs

When considering solar power as a clean energy alternative, understanding solar incentives is crucial for consumers looking to reduce costs and maximize returns. These incentives, often in the form of tax credits, rebates, or grants, can significantly offset the initial installation expenses of solar panels. However, with various programs available, choosing the right one can be challenging. Here’s a comprehensive guide to help you navigate this process and unlock the full potential of your solar investment.

The first step is to assess your eligibility and understand the specific borrower requirements for each incentive program. Many governments offer tax credits that allow homeowners and businesses to deduct a portion of their solar system costs from their taxable income. For instance, in the United States, the federal Solar Tax Credit (ITC) offers a 26% credit on qualified solar energy system expenses. Some states also have their own incentives, such as New York’s Solar and Wind Energy Cost Reduction Program, which provides rebates for residential solar installations. It’s essential to check your local and regional programs as these requirements can vary widely.

To maximize returns, borrowers should consider both upfront and long-term savings. While initial cost savings are attractive, future savings potential shouldn’t be overlooked. Some states offer net metering policies, allowing excess energy generated by your solar panels to be fed back into the grid, reducing your overall electricity bill. For example, California’s Net Energy Metering (NEM) program enables customers to run their meters in reverse, crediting them for any excess energy produced. Additionally, exploring solar loans or power purchase agreements (PPAs) can make solar more accessible and provide predictable monthly payments without a large upfront cost.

When selecting an incentive program, consider the reputation of the provider and the potential long-term benefits. Reputable organizations often offer transparent terms and conditions, ensuring a smooth process. For instance, some community solar programs allow residents to invest in shared solar arrays, providing access to renewable energy at a lower cost. These programs can be especially beneficial for low-income households or those unable to install solar panels on their properties. By carefully evaluating your options and understanding the borrower requirements, you can secure substantial solar incentives, reduce your carbon footprint, and enjoy long-term savings.