Solar incentives, including tax credits, rebates, grants, and net metering policies, significantly reduce upfront costs for property owners adopting solar power. These vary by location and come with specific eligibility criteria. As the cost of solar technology declines, more homeowners are leveraging these incentives to access cleaner energy, contribute to sustainability, and achieve long-term financial savings. Key global incentives include U.S. Investment Tax Credit (up to 26%), state grants/rebates, and utility benefits like net metering. Proper planning and strategic financing choices, guided by professionals, maximize savings and environmental benefits.

In today’s quest for sustainable energy solutions, solar incentives for property owners stand as a powerful catalyst for embracing renewable power. As the world navigates an increasingly complex energy landscape, homeowners have the opportunity to take control of their energy costs and contribute to environmental stewardship. This article provides a comprehensive breakdown of these incentives, revealing how they naturally align with the growing demand for clean energy alternatives. By exploring the benefits and mechanisms at play, property owners can make informed decisions, unlock savings, and participate in shaping a greener future.

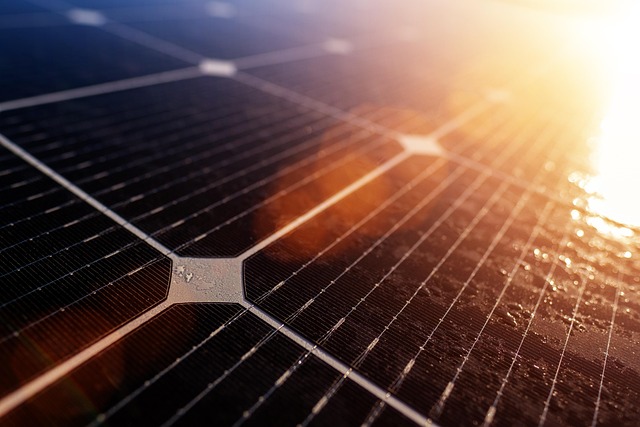

Understanding Solar Incentives for Property Owners

For property owners considering solar energy, understanding solar incentives is crucial to making an informed decision. Solar incentives are financial benefits offered by governments and utilities to encourage the adoption of solar power. These incentives can significantly reduce the upfront costs associated with installing solar panels, making clean energy more accessible and affordable. One of the most common forms of solar incentive is tax credits, which allow homeowners to deduct a portion of their solar system’s cost from their taxable income. For instance, in the United States, the federal investment tax credit (ITC) offers a 30% discount on qualified solar installations through 2022.

Solar incentives also include rebates and grants, where utilities or local governments directly compensate homeowners for installing solar panels. These cash rewards can further offset the installation costs, making it easier for borrowers to meet their financial obligations. It’s important to note that solar incentive programs vary by location, and what is available in one region may differ from another. Property owners should research and stay updated on the specific borrower requirements and eligibility criteria for these incentives. For example, some programs require homeowners to be current on their property taxes and have a good credit history, while others might mandate that the solar system meet certain efficiency standards.

Additionally, many states offer net metering policies, which allow homeowners with excess solar energy to sell it back to the grid at a wholesale rate. This not only offsets electricity bills but can turn a home’s energy production into a source of revenue. As the cost of solar technology continues to decline and incentives remain robust, more property owners are recognizing the financial benefits of embracing solar power. By leveraging these solar incentives, borrowers can access cleaner, cheaper energy while contributing to a sustainable future.

Benefits of Solar Energy Installation at Home

Solar energy installation at home offers a multitude of benefits that extend far beyond environmental sustainability. Property owners who invest in solar power systems can enjoy significant financial savings due to reduced electricity bills, often leading to faster payback periods on their initial investment. This is particularly true in light of the various solar incentives available to borrowers, which have become increasingly generous over time. For instance, federal tax credits, like the Investment Tax Credit (ITC), offer substantial discounts off the overall cost of installation, making solar energy a more accessible and appealing option for many homeowners.

Furthermore, state and local governments often provide additional solar incentives to promote renewable energy adoption. These can include property tax exemptions, rebates, or net metering policies that allow surplus solar energy to be fed back into the grid, resulting in credits on future electricity bills. Many states also have specific programs targeting low-income households, making solar power even more affordable and equitable. For example, some utilities offer discounted rates for solar installations, while others provide grants or low-interest loans, ensuring that financial barriers to entry are significantly reduced.

However, understanding the specific borrower requirements for these solar incentives is crucial. Eligibility often hinges on factors like creditworthiness, income levels, and local regulations. Property owners should research and consult with reputable solar installers who can guide them through the process, ensuring they meet all necessary criteria. By taking advantage of these solar incentives, homeowners not only contribute to a cleaner environment but also position themselves for long-term financial savings, making their homes more energy-efficient and resilient.

Exploring Government and Utility Company Offerings

Solar incentives have emerged as a powerful driver for property owners to embrace renewable energy sources, particularly solar power. Government and utility companies worldwide are actively encouraging the adoption of solar through various offerings and programs. These incentives go beyond mere financial benefits; they also promote environmental sustainability and energy independence. Understanding these solar incentives is crucial for property owners considering a switch to solar energy.

One of the most significant aspects of solar incentives is the federal tax credit, which has been instrumental in spurring solar adoption. The U.S. government, for instance, offers a federal income tax credit of up to 26% for residential solar installations. This credit applies regardless of the size of the system and can be used by homeowners and small businesses alike. Additionally, many states provide their own incentives, such as rebates or net metering policies, further enhancing the financial benefits for solar borrowers. For example, California’s Solar Incentives program offers a variety of grants and rebates to eligible residents. These state-level initiatives often target specific demographics, like low-income households or agricultural operations, ensuring broad access to solar energy.

Utility companies also play a vital role in promoting solar adoption through their own incentive programs. Many utilities offer net metering policies that allow solar system owners to sell their excess energy back to the grid. This can result in lower electricity bills for borrowers and helps to stabilize local power generation. Some utilities go further, providing direct financial incentives like bill credits or up-front rebates for solar installations. For instance, a utility might offer a $100 credit on each kilowatt of installed solar capacity. These borrower requirements typically involve meeting specific criteria, such as owning the property, connecting to the grid, and adhering to local building codes. By fulfilling these requirements, property owners can unlock substantial savings and contribute to a cleaner, more sustainable energy future.

Navigating Tax Credits and Rebates: A Comprehensive Guide

Navigating Tax Credits and Rebates: A Comprehensive Guide to Solar Incentives for Property Owners

Understanding solar incentives is crucial for property owners looking to make the switch to clean energy. At their core, these incentives serve as financial rewards for adopting solar power, offsetting initial installation costs and accelerating the return on investment. The most significant among these are tax credits and rebates, which can significantly reduce the burden of going solar. For instance, the federal Investment Tax Credit (ITC) offers a 30% discount on the cost of solar systems, while many states provide additional incentives through sales tax exemptions or rebates.

Navigating these benefits requires careful consideration of borrower requirements. Property owners must assess their eligibility based on factors like creditworthiness and local regulations. For example, some rebates are contingent on meeting specific energy efficiency thresholds, encouraging comprehensive home upgrades that further reduce utility bills. It’s essential to consult with professional installers or financial advisors who can guide through the application processes, ensuring compliance and maximizing savings.

The strategic use of solar incentives can make a substantial difference in the long-term viability of solar energy adoption. Property owners should remain informed about evolving policies and take advantage of available rebates and credits. For instance, some utilities offer time-of-use pricing structures that align with solar production patterns, allowing homeowners to sell excess energy back to the grid at peak rates. By staying abreast of these developments and leveraging existing incentives, borrowers can capitalize on substantial savings while contributing to a sustainable future.

Financing Options for Solar Panel Adoption

Property owners considering solar panel adoption are increasingly drawn to the environmental and financial benefits of harnessing clean energy. Financing options play a pivotal role in this decision, as understanding the available incentives can significantly impact the upfront costs associated with solar installations. The landscape of solar incentives has evolved, offering various avenues for borrowers to fund their transition to renewable energy sources.

One prominent aspect is the federal tax credit, currently at 30%, which acts as a powerful incentive for solar adoption across the nation. This credit, available to borrowers who meet specific criteria, effectively reduces the overall cost of solar panel systems. For instance, a homeowner in California with a median-priced home could expect a federal tax credit saving of approximately $1,500. Additionally, many states offer their own incentives, such as rebates or net metering policies, further lowering the financial barrier to entry for prospective solar owners. These state-level initiatives vary widely, providing borrowers with tailored support based on regional energy dynamics and policy priorities.

Borrower requirements for accessing these solar incentives are crucial considerations. Typically, homeowners or businesses must demonstrate a commitment to long-term energy savings and responsible borrowing practices. Lenders assess creditworthiness and loan-to-value ratios to ensure borrowers can handle the financial obligations associated with their solar investments. As a result, proper planning and strategic financing choices become essential components of a successful solar panel adoption strategy. Property owners should consult professionals who specialize in solar financing to navigate these requirements effectively, ensuring they access the full spectrum of available incentives tailored to their unique circumstances.

Long-Term Savings and Environmental Impact

Solar incentives offer property owners a compelling opportunity to save money while contributing to a sustainable future. One of the most significant benefits is the long-term financial savings associated with solar energy adoption. By leveraging solar incentives, borrowers can reduce their reliance on traditional electricity providers and lower their monthly energy bills significantly. For instance, a study by the U.S. Energy Information Administration (EIA) indicates that the average residential solar system in the United States saves homeowners around $100 per month on utility expenses over a 25-year period. These savings can be even more substantial for properties with higher energy consumption or those located in regions with higher electricity rates.

Moreover, the environmental impact of solar energy is profound. Solar incentives play a pivotal role in encouraging the widespread adoption of renewable energy sources, reducing the carbon footprint of communities. According to the International Energy Agency (IEA), global solar capacity has grown exponentially in recent years, avoiding approximately 90 gigatons of CO2 emissions since 2010. This growth is largely driven by supportive policies and incentives that make solar energy more accessible and affordable for homeowners. By transitioning to solar power, property owners contribute to a cleaner, healthier environment for current and future generations.

However, navigating the world of solar incentives requires an understanding of borrower requirements. Potential stakeholders should be aware that eligibility criteria vary depending on the incentive program and location. Common requirements include meeting specific energy efficiency standards, owning the property, and adhering to local building codes. For example, some programs offer tax credits or rebates directly to homeowners, while others provide low-interest loans or power purchase agreements (PPAs). It is essential for borrowers to thoroughly research available options and consult with professionals to determine which incentives align best with their circumstances. By doing so, they can maximize long-term savings and environmental benefits while ensuring a smooth transition to solar energy.