Selling your home? Leverage solar incentives for significant savings on energy costs and increased property value. Research regional tax credits, grants, and rebates. Highlight solar panel advantages to buyers. Marketing benefits include financial stability and eco-friendliness. Solar systems lower utility bills and enhance home appeal.

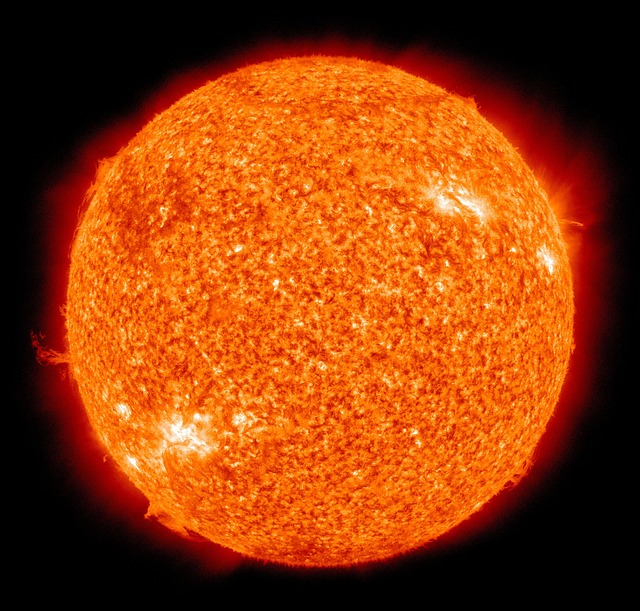

In today’s rapidly evolving market, solar incentives have emerged as a powerful tool to encourage homeowners to embrace renewable energy. As the global push for sustainable living intensifies, understanding these incentives is crucial for both sellers and buyers alike. This article delves into the intricate world of solar incentives, offering a comprehensive guide for sellers looking to navigate this lucrative opportunity. By exploring various financial incentives, tax benefits, and long-term savings, we empower sellers to make informed decisions that not only boost their bottom line but also contribute to a greener future.

Unlocking Savings: Understanding Solar Incentives for Sellers

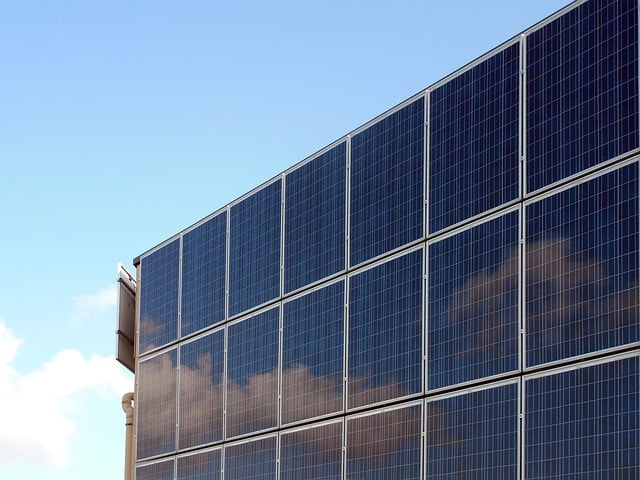

Selling your home? Unlocking significant savings might be easier than you think—it’s all about understanding solar incentives. These incentives, designed to promote renewable energy adoption, offer substantial benefits for sellers in today’s real estate market. By harnessing the power of the sun, not only do you contribute to a greener environment but also potentially increase your home’s value and reduce long-term energy costs.

One of the key drivers behind solar incentives is government support, which varies by region. Many countries and states offer tax credits, rebates, or grants for homeowners who install solar panels. For instance, in the U.S., the federal Solar Tax Credit (ITC) allows borrowers to claim a tax credit of up to 30% on their solar system costs. Additionally, some state and local programs provide further incentives, such as low-interest loans or property tax exemptions for solar installations. These benefits can significantly offset the initial investment required for solar panel installation, making it an attractive option for sellers looking to boost their bottom line.

Solar incentives also cater to borrower requirements, providing flexible financing options. Lenders often offer specialized solar loans designed to align with the unique needs of homeowners. These loans allow borrowers to incorporate solar system costs into their mortgage, making the upfront investment more manageable. For example, some lenders may provide a solar loan with a lower interest rate or a fixed-rate structure, ensuring predictable monthly payments over the life of the loan. By understanding these borrower requirements and exploring available incentives, sellers can navigate the process effectively, potentially saving thousands of dollars in energy costs over time.

Navigating Solar Incentive Programs: A Step-by-Step Guide

Selling your property? Considering solar incentives can be a game-changer, offering significant financial benefits for both you and the environment. This guide will walk you through navigating complex solar incentive programs, ensuring you unlock maximum value. First, understand that these programs aim to promote renewable energy adoption by providing tax credits, grants, or rebates to homeowners who install solar panels. These incentives can drastically reduce installation costs, making solar power more accessible.

A crucial step is researching your region’s specific solar incentive policies. Programs vary widely; some target individual homeowners while others encourage large-scale adoptions. For instance, the federal Investment Tax Credit (ITC) offers a substantial tax credit for solar panel installations, with borrower requirements focusing on income eligibility and timely filing. Many states also have their versions, like net metering programs that allow excess energy production to be fed back into the grid, offsetting future electricity bills. Ensure you’re aware of these benefits and how they apply to your situation.

When preparing to sell, highlight the advantages of solar power to potential buyers. Not only does it reduce utility costs, but many appreciate the environmental benefits. Presenting a comprehensive understanding of local solar incentive programs will demonstrate your knowledge and commitment to sustainable living. Remember, these incentives are designed to encourage a transition to cleaner energy sources, making your property more attractive in today’s market. By following this step-by-step guide, you can maximize the value of your home while contributing to a greener future.

Maximizing Returns: Solar Incentives and Their Impact on Selling Homes

Selling a home can be a complex process, especially when navigating the financial incentives available through solar energy adoption. Solar incentives are designed to encourage both homeowners and sellers to invest in solar panel installations, offering significant benefits that can maximize returns on property sales. Understanding these incentives is crucial for sellers looking to make informed decisions about their homes’ value and marketability.

One of the primary advantages lies in the potential for substantial cost savings. Many solar incentive programs provide financial assistance, such as grants or tax credits, which can cover a portion or all of the installation expenses. For instance, the Federal Solar Tax Credit allows homeowners to deduct 26% (as of 2021) of eligible solar system costs from their taxable income. These savings can significantly enhance a home’s appeal to buyers, who increasingly prioritize energy-efficient features. According to a recent survey, over 85% of homebuyers would consider a home with solar panels, demonstrating the market’s demand for these eco-friendly upgrades.

Additionally, sellers should be aware of the role solar incentives play in meeting borrower requirements. Lenders often view homes equipped with solar systems as less risky investments. This is because solar installations can lower utility bills, ensuring more predictable and sustainable mortgage payments for borrowers. For example, a study by the U.S. Department of Energy found that homeowners with solar panels on average save $100 or more per month on energy costs. Such savings are particularly attractive to prospective buyers who wish to establish long-term financial stability in their new homes. When marketing a property with solar incentives, sellers can emphasize these benefits, assuring potential buyers of both environmental stewardship and economic prosperity.